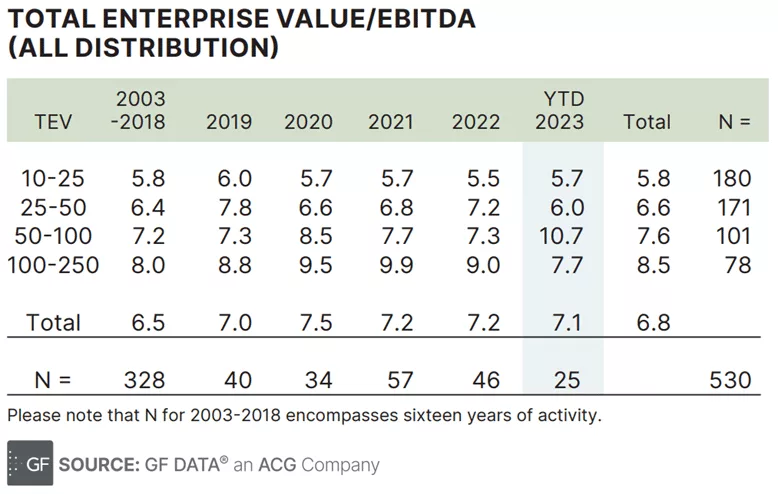

GF Data® reported on the Distribution business acquisition deal data for YTD December 2023 and while valuations are holding steady, deal volume is down 25-30% vs 2022. The decline in volume is not surprising, given the high cost of debt. However, the fact that valuations appear to be holding steady is, on the surface, surprising. Yet, when considering that perhaps only the best businesses are selling, and if valuations truly remained constant, we would expect to see an increase in multiples. The absence of such an increase could be explained because higher-quality businesses would have sold at higher multiples in 2021 or 2022. In reality, valuations for these businesses have declined, as expected, to offset higher borrowing costs. This correlates with our own experience in the market.

TEV = Transaction Value in $millions. The range is $10 million to $250 million.

GF Data deal sizes start at $10 million, but we also considered smaller deals provided by DealStats®. These encompass a wider range of deal sizes and involve various types of buyers. The average deal size is $4 to $5 million in revenue, with deal values mostly falling between $1 and $7 million. In 2023, deal volume is down as expected, but EBITDA multiples for valuations are up, possibly for the same reasons as noted above.

Wholesale Distribution Deal Data – Small Deals

| Year | # Deals | Revenue Range | Avg Revenue | Avg EBITDA | Price/EBITDA |

| 2023 | 18 | $2 – $25 mil | $4.4 | 0.57 | 4.4 |

| 2022 | 29 | $2 – $25 mil | $5.2 | 0.72 | 4.3 |

While deal volumes are down, the overall number of wholesale distribution deals in the U.S. and Canada in 2023 will exceed 774 transactions as reported by Pitchbook®. Several deals of note:

Future Electronics, a distributor of electronic components, was acquired by WT Electronics for $3.8 billion or 1.3x revenue. No EBITDA data is available.

Tessco Technologies, a value-added communications technology distributor, was acquired by Alliance Corp., Lee Equity Partners, and Twin Point Capital for $161 million or .36x revenue.

Applied Industrial Controls, a supplier of industrial control and automation products, was sold to Frontenac Company for an undisclosed amount.

Sectors with deals were wide-ranging from jewelry, industrial, technology, oil, and gas to food.

As we start 2024, our activity is healthy, indicating that the upcoming year will be as good as, if not better than, 2023, especially if interest rates start dropping.

If you’re interested in discussing these insights and understanding how they may impact your own M&A plans, feel free to contact us for a confidential conversation here, or to learn more about our M&A team, visit us here.