Business Sales – Q3 2020 Market Pulse Survey Summary

The quarterly IBBA and M&A Source Market Pulse Survey was created to gain an accurate understanding of the market conditions for businesses being sold. For the third quarter 2020 352 business brokers and intermediaries participated in the survey. These advisors completed 301 transactions. This summary was created by BMI from the Market Pulse Survey with a focus on transaction values between $2 and $50 million.

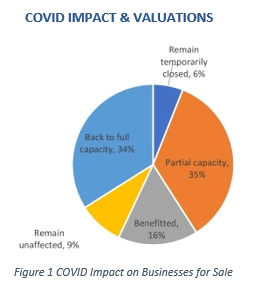

Advisors reported that 25% of the businesses represented either were not impacted by Covid or they saw a benefit. Another 34% are now back to 100% of pre-Covid levels, meaning 59% are operating at normal levels even as the pandemic continues.

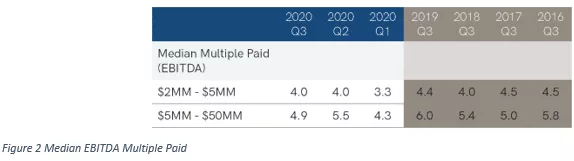

Valuation multiples are down approximately 9% vs the prior four years, however three quarters of advisors believe valuation multiples will remain steady or increase over the next three months. It is also important to note that we are coming off of peak valuations at the end of 2019 and these were not expected to continue indefinitely even without a pandemic.

Despite the decline versus multi-year averages, valuation multiples have recovered from Q1 lows when the initial shock of the pandemic and widespread shutdowns shook the M&A market.

EXPECTATIONS

Although some advisors believe the M&A market has already returned to normal, the majority believe that has not happened yet but will occur in Q2 or Q3 of 2021. M&A volume was healthy in Q3 and remains so in Q4 however as noted elsewhere in the survey, deals face headwinds from Covid impacts.

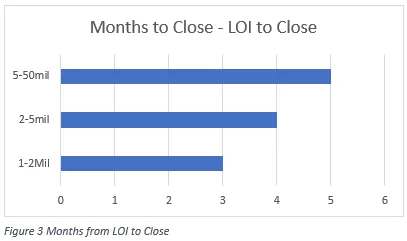

TIME TO CLOSE

Usually in times of uncertainty, the time to close deals increases, however in Q3 there was very little uptick in the time from LOI to close. This is attributed to incentives from the CARES Act which provided six months of principal and interest payments on certain transactions that closed by September 27, 2020. As noted below, larger deals take longer to close.

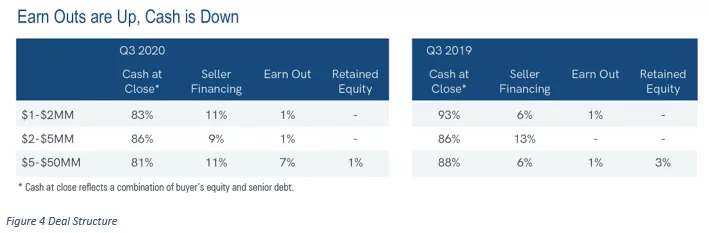

FINANCING – DEAL STRUCTURE

We noticed an increase in earn outs in Q3 and that was reflected in the survey data. Buyers still had the desire to complete acquisitions but the uncertainty around Covid led to more risk sharing in deal structures.

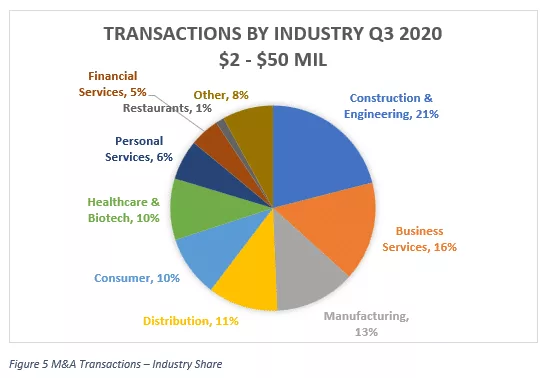

TRANSACTIONS BY INDUSTRY

There was a notable increase in transactions completed in the construction and engineering industry which accounted for 21% of deals versus about 17% in prior periods.

The MARKET PULSE SURVEY is a collaboration of the IBBA and M&A Source with the support of the Pepperdine Private Capital Markets Project and the Pepperdine Graziadio Business School. Some BMI Mergers & Acquisitions advisors are members of the IBBA and M&A Source.