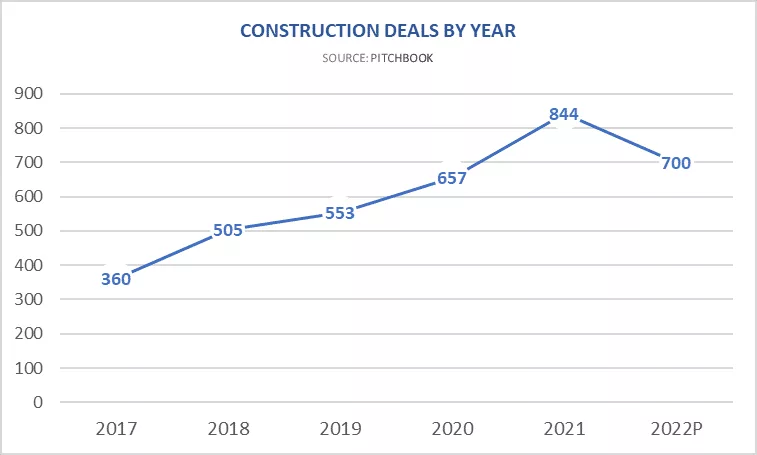

Construction M&A Deal Activity Slows In 2022 But Remains Healthy

Construction-related deals for the first 8 months of 2022 totaled 498 which is a lower pace than 2021. However, as seen below, this is still a very healthy level of deal volume. In short, 2021 was an extraordinary year for M&A in every industrial sector, including construction. Economic headwinds, especially higher interest rates in 2022, have somewhat dampened activity, yet that activity remains strong as deal makers assess the possibility of a limited downturn. Further boosting the construction market is the 2021 Infrastructure Investment and Jobs Act, a $1.2 trillion bill with investments in roads, bridges, public transport, airports, ports, and other infrastructure.

Private company valuations also peaked in 2021, which is no longer the case as deal values have declined to levels more like those seen in 2017-2018. Heavy and Civil Engineering Construction businesses have sold in 2022 at an average of 5x EBITDA. Public company valuations have declined from a market cap to EBITDA ratio of 11.69 on January 1, 2021, to 9.48 as of August 31, 2022.

Outlook

The infrastructure construction industry faces a combination of rising interest rates, continuing robust demand, and new incentives from federal government infrastructure and renewable energy initiatives. While everyone is watching the markets closely, business sales in infrastructure-related construction are expected to remain strong for the foreseeable future, albeit at a slower pace than in 2021.

Recent Market Transactions 2022