Lower Middle Market Business Sales

I. Where Are We Coming From – 2021-2022

The best time to sell a privately held business were the years 2021-2022, as valuations and deal volumes reached a peak not seen over the previous 20 years. We looked at data on five industries and found that all had peak valuations in the last two years. Competition for businesses was fierce and as a result it was a sellers’ market and sellers often had their way with deal terms. None of this was surprising given the huge amounts of cash in the economy on top of very cheap debt.

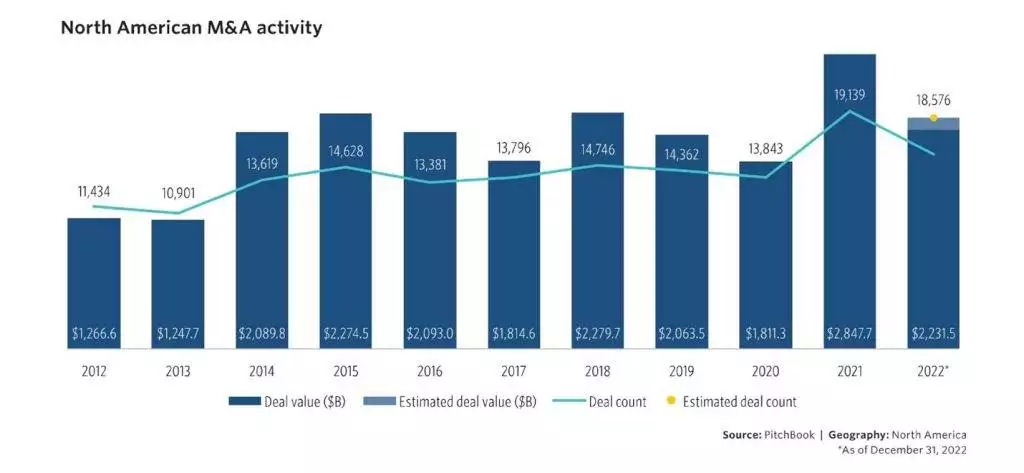

Things moderated as deal volume and deal value in 2022 was down from 2021 but still higher than average pre-pandemic levels. See chart below with volumes and values from 2012 to estimated 2022.

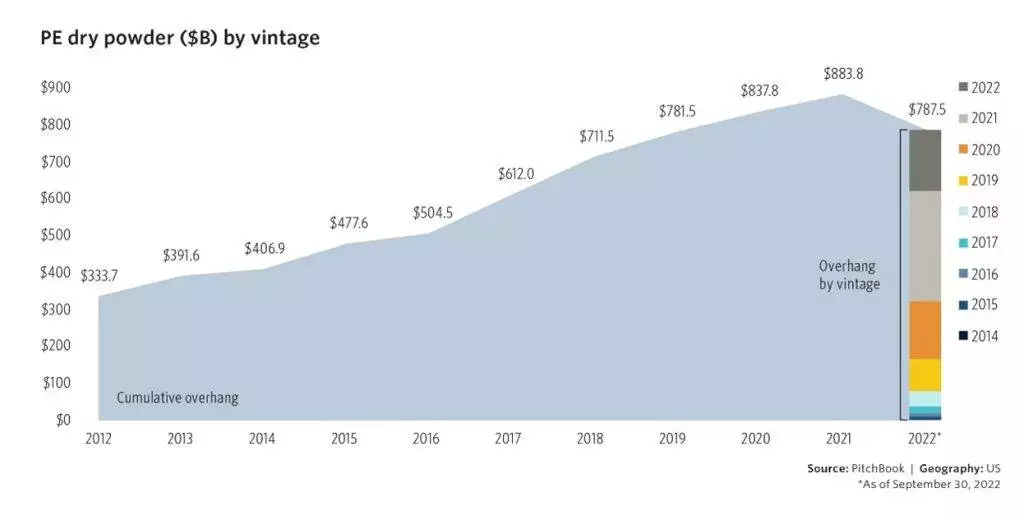

Private equity is sitting on near record levels of cash for investment and strategics are also flush with cash after several very good profit years, so as we proceed thru 2023 the equity side of transactions looks strong.

II. Macro-Economic Picture 2023

The Federal Reserve increased interest rates by .25% in February 2023 and may make a few more similar moves this year putting further pressure on the cost of borrowing. Inflation is moderating but is not yet near the Fed’s target range. Despite the rising interest rates, overall the economy remains relatively strong and some economists are discussing the possibility of avoiding a recession, however this remains very controversial. GDP grew by 2.9% in Q4 of 2022 and the jobs report remained strong as 517,000 new jobs were added in January 2023. Further clouding the outlook was the manufacturing index declined again in January 2023 while the ISM (non-manufacturing) index increased. 2023 will be impacted by moderating interest rate increases, as well as China’s reopening and the Ukraine war. The post pandemic hyper economy was not sustainable and it is over. 2023 looks to be a return to a more normal situation with some uncertainty.

III. Buyers Activity & What They are Seeking

For evidence of buyer activity, I only needed to check my own inbox for the past 9 days where I counted 33 general inquiries from buyers, mostly private equity, looking for acquisitions. This is as steady a flow as we have ever seen. Private equity continues to raise funds and actively seek investments and to back up their claims of wanting to make acquisitions in 2023, many are adding staff to support their activities. Requests focus on add-ons for current portfolio companies but interest continues in finding quality platform investments. Many are industry agnostics while others are looking for specific targets in manufacturing, value add distribution, specialty services, building materials, healthcare and technology. Buyers are interested in quality companies that will do fine no matter the current economic environment. They know good companies survive and thrive and they will be rewarded in the long term. KLH Capital has been following this same philosophy in the past and as they actively seek acquisitions in 2023. Per Ron Moore, Vice President of KLH, we are seeking targets in the industrials and outsourced BtoB service sectors that are steady and generally resilient regardless of the macro-economic trends.”

Deals are expected to take longer as buyers and lenders perform more due diligence particularly around a company’s ability to weather downturns. Most buyers utilize debt as part of their deal structures and while debt has become more expensive, it is still available to support deals. GF Data reported equity contributions at 50% for 2022 vs 48.1% in 2021 and a five year low of 46.7% in 2019. Costs have gone up and availability down but not enough to take out middle market M&A. According to David Barnitt of Attract Capital, a mid-market debt advisory firm, “Borrowing is still an option, but the dynamics have changed as banks have pulled back and are much more cautious, however alternative lenders such as mezz funds, unitranche facilities, and finance companies have stepped in. The cost of borrowing has increased but is still affordable so debt deals are getting done. Of course the 800 pound gorilla in the room is the tremendous amount of equity capital that has flowed and continues to flow into the middle market. Transactions are getting done albeit with more focus on quality.”

IV. Valuations

While one quarter does not make a trend, Q4 2022 middle market valuations as reported by GF Data® declined from recent record highs coming in at 6.8x ebitda which is right in line with longer term historical averages also at 6.8x. No one knows for certain what will happen in this next economic cycle, but investment in small/medium businesses is now recognized as a good investment and therefore investor funds continue to flow into mid-market business acquisitions. State Street in their 2023 Private Markets Study recently surveyed asset managers and had this conclusion, “Even though public markets are grappling with a low-yield environment, the private markets space looks positive. According to our study, 68 percent of investors will continue to grow private markets allocations in line with current targets, despite rate rises reducing the attractiveness of leveraged strategies.” As noted above buyer activity is very strong and it seems this strength will hold up valuations in a normal to slightly strong historical range.

V. What Should a Business Owner Do?

We are often asked, is now a good or a bad time to sell? 2023 will not be like 2021 which was quite possibly the best time ever to sell. As our survey of the market shows, 2023 does not look like a bad time to sell, but we think the real answer depends as always on two important questions: 1) What are your personal goals and what would a sale have to look like to achieve those? Your age, life goals, health, desire to work and in what capacity, can be more important than anything else. Good businesses give sellers options to meet their goals which brings us to the second question. 2) Is your business ready to sell? Most businesses have one or two weaknesses which can be overcome in a sale process but some weaknesses or too many major weaknesses are value and deal killers. Evaluate your business and situation with experienced M&A advisors to determine where you stand.

To download a PDF version of this report, click here.

About BMI Mergers & Acquisitions

For over twenty-five years, we have been successfully engaged in the practice of buying,

selling and managing the business acquisition process. Our professionals have been

engaged in transactions in a multitude of industries. They have completed multi-million

dollar deals, and they have also successfully integrated businesses post-merger. Whether

your business is worth $5 million or $100 million, this experience is put to work to achieve

your desired result.