Introduction

BMI has seen robust business acquisition activity from buyers and sellers in 2023, even though economic trends and credit availability remain uncertain. Our takeaway from all the data is that the positives outweigh the negatives, and while there are headwinds, the overall trend is one of strengthening.

Companies holding steady

Company financials reflect a stable economic environment, with revenues mostly holding steady, albeit with some mild pullbacks compared to the booming period of 2021-22. While supply issues have largely subsided, certain businesses still face shipment challenges. On the positive side, costs have stabilized and, in some cases, even decreased. Large corporate earnings are reflecting the same….as 79% of reporting companies beat Q1 expectations (FactSet)

Resilience in the Face of Recession Predictions

Most economists continue to predict the possibility of a recession, but their certainty is declining as the economy shows resilience. However, buyers remain cautious and concerned when they observe even slight declines in revenue. They seek reassurance that such declines are not indicative of a downward trend but rather typical fluctuations in a stable revenue environment.

Impact of Rising Interest Rates and Credit Availability

One area of concern revolves around rising interest rates and their potential impact on office real estate. There are worries that this could lead to reductions in bank credit availability, including for M&A deals. Although this remains a developing story, its full impact may not be felt in the mainstream for months.

The good news is that interest rate increases seem to be nearing their end, providing some certainty for planning purposes. The question now is how long rates will stay elevated before beginning to decline. On another front, new bank capital rules are expected to be released on July 27. These rules are likely to require more banks to hold more capital, potentially resulting in less availability of credit. This could have its biggest impact in the lower middle market, where business acquisition deals are usually too large for SBA backing, and it falls to mid-size banks to supply the capital.

Private Equity Deals: A Changing Landscape

Private equity deals have seen significant changes since 2022. Debt as a percentage of enterprise value has declined from 50.8% to 43%, indicating a more conservative approach and more expensive debt capital. Private credit, which has played a crucial role in supporting the market since big banks withdrew, remains robust. Additionally, big banks have started providing credit on LBOs (leveraged buyouts).

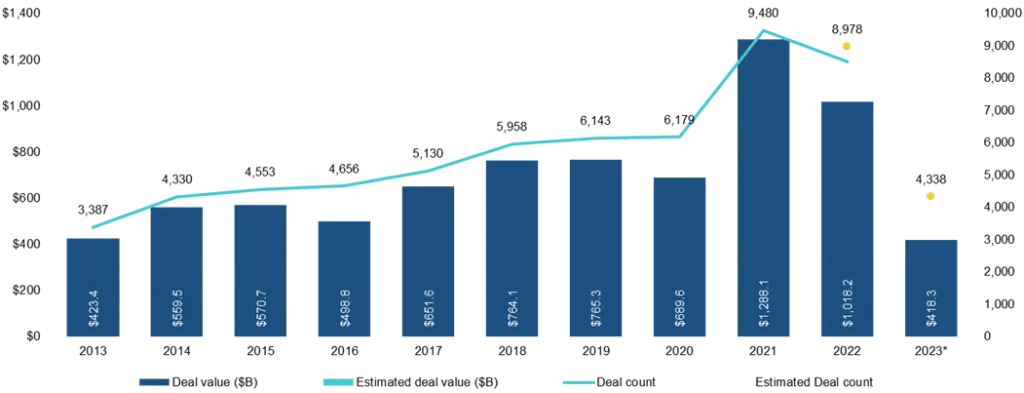

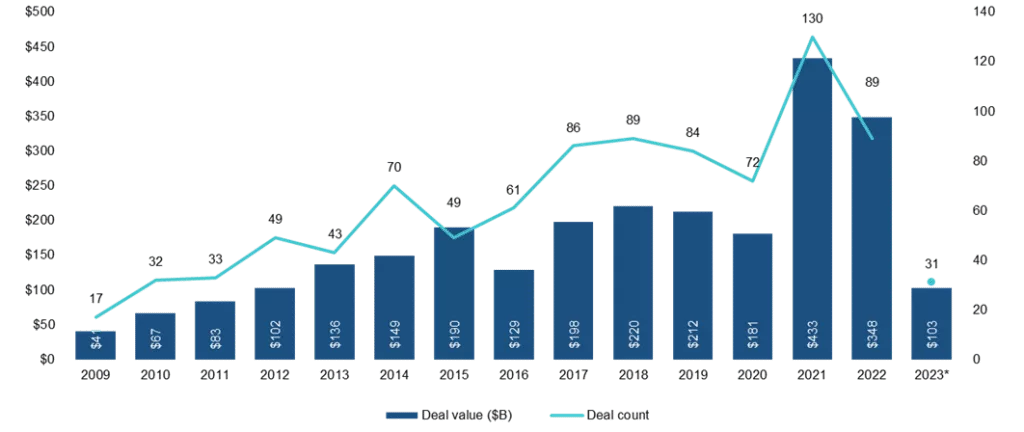

According to Pitchbook’s Q2 US PE Breakdown report, the private equity industry has maintained pre-COVID-19 levels of deal activity, which were considered strong years before the 2020 to 2022 frenzy set the bar high. While overall PE deal activity is on par with 2022 and surpasses any year prior to 2021, deals in the over $1 billion category have reached their lowest level since 2016, reflecting the challenges of financing larger deals and the resiliency of the middle market.

PE Deal Activity – All Sizes – including six months 2023 (Pitchbook):

PE Deal Activity – Over $1 Billion – including six months 2023 (Pitchbook):

Vibrancy in the Lower Middle Market

Activity in the lower middle market, including companies with $5 to $100 million in revenue, remains strong. The number of owners testing the market has increased, while buyer interest has not waned from the heated pace in recent years. As a result, valuations in this segment have remained relatively steady. In contrast, larger deal sizes have experienced a notable decrease in valuations, ranging from 10% to 20%.

Private equity firms, anticipating weaker returns when selling portfolio companies, are currently holding onto these assets instead of selling them, thereby also leading to increased demand for non-backed privately held companies in the lower middle market.

Conclusion

The Q2 Middle Market M&A Report portrays a resilient landscape. Despite concerns about a potential recession, the economy has shown remarkable strength. The stabilization of costs and interest rates has provided a sense of certainty for businesses planning their strategies. The private equity sector has experienced notable shifts, with lower debt levels and sustained deal activity. The lower middle market remains vibrant, attracting significant interest from both buyers and sellers, leading to stable valuations in this segment.