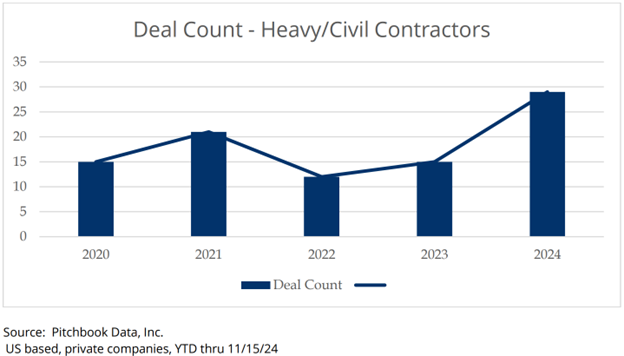

In 2024, we observed a significant increase in M&A deal activity in the lower middle market for specialty trades contractors and, specifically, for heavy/civil construction contractors.

In this update, we look back at year-over-year deal activity, including 2024 for heavy/civil contractors, share examples of recent deals, and consider what makes these companies attractive to buyers.

For this update, heavy/civil contractors encompass several subsectors such as highway, bridge, street construction & material producers, railway, and marine contractors with revenue between $5M – $75M.

While the upward trend may be partially related to a COVID recovery following 2022, we believe the gains are also attributed to a strong outlook for the sector.

We expect heavy/civil contractors to remain very busy in the coming years as the nation’s infrastructure systems continue to need major repairs and upgrades. Ongoing federal, state, and local government funding measures support the work. The steady work heavy/civil contractors enjoy makes them attractive targets for acquisition. While smaller heavy/civil contractors are attractive targets for strategic buyers, who are often larger contractors doing similar or complementary work, we also believe the heavy/civil sector will remain attractive to financial buyers such as private equity investors seeking acquisitions in the industry. The deal examples below are representative of the sector’s activity in 2024. It’s worth noting that these buyers have completed multiple acquisitions over the last two years.

Recent infrastructure contractor acquisitions:

West Rail Construction, a provider of railway construction and maintenance services in the northwestern United States, was acquired in March 2024 by American Track Services, a subsidiary of North American Rail Solutions. The acquisition of West Rail Construction allows American Track Services to expand its coverage into the northwest region, a new service region for the company. North American Rail Solutions, based in Texas, with operations around the US and Canada, is the largest provider of railway design, construction, and maintenance services in North America. North American Rail is a portfolio company of the DFW Capital, a private equity investment firm based on New York, NY. Their affiliate companies include industrial support services, outsourced business services, and healthcare.

The Scruggs Company, a platform company of Construction Partners, Inc. acquired Littlefield Construction Company, a Georgia based roadway and site preparation contractor in January 2024. Construction Partners, Inc., is a strategic buyer who operates across the southeast states as a vertically integrated material producer and contractor. Much of Construction Partners’ work is publicly funded including paving for local roads, highways, airports, and bridges. They also work on private projects doing paving and site development for residential communities and commercial developments.

Aaron Materials, a south Texas based concrete recycler and materials producer was acquired in July 2024 by Heidelberg Materials North America, part of the broader Heidelberg Materials company based in Germany. The asset sale, considered a bolt-on by Heidelberg, increases their market presence for recycled materials in the south Texas region. Heidelberg entered the US market with its acquisition of Lehigh Cement in 1977. Heidelberg went on to make multiple acquisitions in cement and heavy building materials, including the major acquisition of Hanson Materials, which in 2006, was considered the largest producer of construction aggregates.

In examining the deals in greater detail, we see the buyers seeking to increase market share in regions where they currently operate, expand to new geographic regions, and/or add complementary services as part of their strategic growth plans. The sector is also attractive because its pipeline of work is more protected in an economic downturn, compared to other construction sectors such as commercial building, for example. While all contractors who build new construction projects face challenges like increased competition or margin aggression in a downturn, heavy/civil contractors will engage in ongoing maintenance and repair work to keep their operations busy when not working on new construction. Roads, bridges, and railroads still need to be fixed regardless of economic changes.

Heavy/civil contractors are also seeing their business valuation trend upward. In the lower middle market, acquisition targets are often valued based on a multiple of EBITDA (earnings before interest, taxes, depreciation, and amortization). In the construction industry, multiples can vary widely by sub-sector. Our research indicates the heavy/civil subsector has garnered higher multiples relative to similar sized companies in other sub-sectors such as commercial or residential building. For more analysis on current construction valuation and how it differs across industry sub-sectors, be sure to read Construction Industry Valuations and EBITDA Multiples.