A Surge in Connections: Electrical Contractor M&A Rebounds

The U.S. electrical contracting sector rebounded in merger and acquisition (M&A) activity in 2024, following a slowdown in 2023. This resurgence reflects a return to more favorable economic conditions after a tough period of rising inflation, increasing interest rates, and economic uncertainty.

Private Equity Platforms Powering Up

Much of the activity in recent years has been driven by financial buyers forming a platform company, followed by strategic add-on acquisitions in the same sector. In 2022 and 2023, many buyers focused on digesting and improving portfolio companies versus launching new platform investments but focused on bolt-on deals in 2024. Corporate strategic buyers reduced M&A activity by 45% since the peak in 2021, but many large corporate acquirers are still on the hunt, including multinational buyers.

Energized Deal Activity in 2024

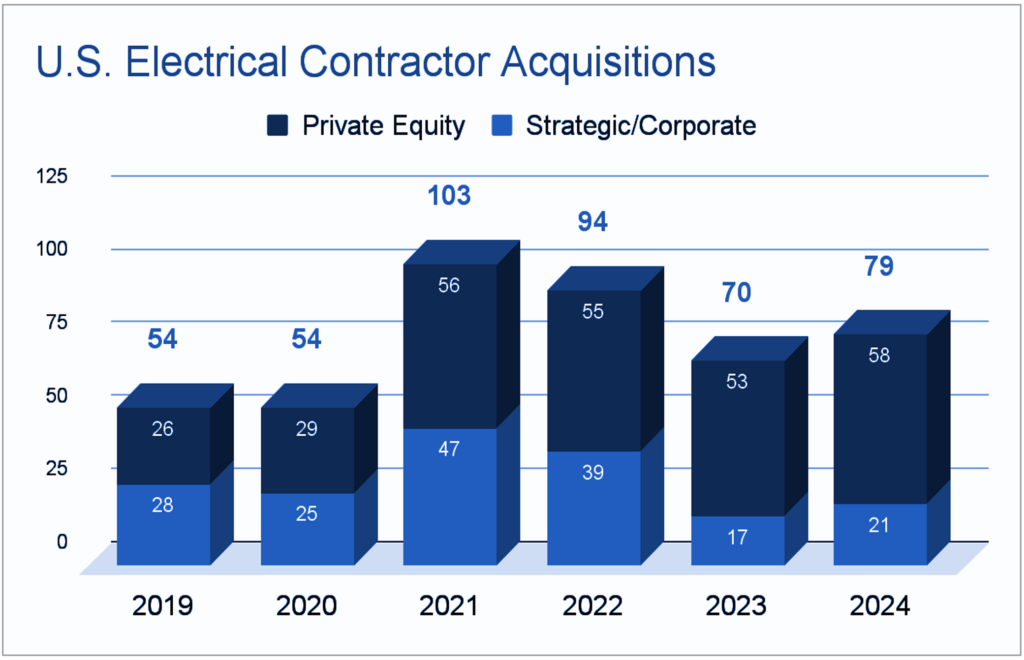

Per PitchBook Data, M&A volume for lower middle market electrical contractors increased 13% in 2024. Many market participants expect M&A volume to increase again in 2025. At the same time, valuations are rising for attractive targets.

M&A deals represented in the chart include contractors engaged in commercial, residential, industrial, and utility scale work, including those who offer other MEP services such as plumbing and HVAC.

Increased Valuations: A Bright Outlook for Electrical Contractors

The strong performance of the electrical contracting sector is also reflected in rising business valuations. Per GF Data, average EBITDA multiples for Specialty Contractors in general have remained steady in the 6-6.5x range over the last 5 years, with smaller or less attractive companies tending to sell for 5.0x or less, and larger, more attractive companies selling for average multiples of 7.0-8.0x or higher. Although there are fewer data points, GF Data indicates that average EBITDA multiples specifically for electrical contracting deals are higher, with smaller deals ($3-8 million EBITDA) averaging 6.2-6.4x and larger deals ($8 million + EBITDA) commanding 7.8x EBITDA on average.

The Key to High Valuations: Recurring Revenue and Quality of Earnings

- Significant recurring service revenue (such as preventative maintenance)

- Upgrade/retrofit jobs valued higher than new construction, due to less economic volatility

- Consistent profit margins, cash flow and growth, strong financial controls

- Deep bench of continuing management and stable team of licensed electricians

- Diversified base of attractive repeat customers without significant concentration

- Bonding requirements and union exposure turn off some financial buyers, but corporate buyers are more flexible

Key Trends Powering M&A Activity for Electrical Contractors

A clear trend is the acquisition of smaller, specialized contractors by larger strategic players and those backed by strategic private equity. This strategy allows acquirers to:

- Strengthen market share with increased exposure to attractive subsectors, such as low-voltage and BMS/Smart Buildings

- Grow in end markets, such as data/telecom centers, life sciences, renewable energy, and infrastructure

- Expand geographic reach locally or nationally

- Diversify service offerings, such as packages of MEP (mechanical, engineering, and plumbing) services to an existing customer base

Surging Prospects for Electrical Contractors in 2025 and Beyond

Several factors contribute to the positive outlook:

- Strong Project Backlogs: The Associated General Contractors/Sage Outlook survey forecasts increased investment in key sectors like data centers, education, manufacturing, and healthcare, all of which require significant electrical contracting work.

- Grid Modernization: Investments in upgrading aging electrical grids and expanding renewable energy infrastructure create opportunities for contractors specializing in transmission and distribution projects.

- Recurring Revenue Streams: Electrical contractors benefit from recurring revenue from maintenance and repair services, providing a stable income stream..

- Higher Profit Margins: Due to the technical nature of the work and the prevalence of self-performed services, electrical contractors typically enjoy high profit margins.

Notable Electrical Contractor M&A Transactions in 2024: Illuminating Success

Private Equity Platform Company Expands Geographic Footprint

CAI Capital Partners, a Vancouver-based private equity firm, acquired Indiana-based Midwestern Electric in 2021, a contractor based in Indiana, focused on infrastructure electric work and provides specialty electrical services for commercial and industrial markets. Since then, Midwestern has completed 3 add-on deals, including California-based Bear Electrical Solutions in October 2024.

Japanese Strategic Buyer Continues Electrical Contracting Expansion in U.S.

Sojitz Corporation, a global Japanese trading company, holds a prominent position in environmental, energy, and power infrastructure, specializing in renewable energy, energy saving, and energy transition. Building on its 2021 acquisition of Pennsylvania-based HB McClure, Sojitz expanded its U.S. presence in October 2024 with the acquisition of Maryland-based Freestate Electric, a leading electrical solutions provider in the metro Washington DC region. Freestate offers general electrical construction and maintenance services for a range of commercial and industrial projects, including schools, data centers, hospitals, and government facilities. Sojitz plans to continue its regional expansion through strategic M&A.

Private Equity Platform Expands Full-Service MEP Capabilities and Gains Leadership

Horwitz, a Minnesota-based portfolio company of Svoboda Capital Partners, acquired Preferred Electric in November 2024. Preferred Electric is a well-established electrical contractor specializing in commercial and industrial sectors. For Horwitz, this acquisition was a strategic step in becoming a more comprehensive multi-service MEP provider. The owner of Preferred Electric now leads Horwitz’s expanded electrical team.

Strategic Buyer Expands Service Offerings and Strengthens Regional Presence

Mayer Electric, an electrical and limited energy contractor based in North Dakota, was acquired in April 2024 by Hunt Electric, a national electrical design, build, and maintenance contractor based in Minnesota. Mayer’s work includes electrical construction and limited energy (voice, data, fiber, security, and fire alarms) services for commercial, residential, and government projects. Mayer is one of several acquisitions made by Hunt in 2024. The acquisition expands Hunt’s services in the region as well as enhancing operations with Mayer’s services.

Considering Expanding or Exiting Your Electrical Contracting Business?

Current market conditions present a compelling opportunity for contractors considering an M&A transaction. If you’re exploring your options and would like to discuss the potential value of your company or formulate an acquisition or exit plan, we encourage you to contact BMI for a confidential consultation.

About the Authors

Jeff Shannon: Senior M&A Advisor, BMI Mergers & Acquisitions. Over 25 years of construction leadership experience at both the project and executive levels. Certified Mergers & Acquisitions Advisor (CM&AA).

Jane Marlowe: Senior M&A Advisor, BMI Mergers & Acquisitions. Over 30 years of M&A transaction experience. Specializes in advising entrepreneur-built industrial, specialty contracting, facility services, and construction companies. Registered Investment Banking Representative with StillPoint Capital, LLC, member FINRA and SIPC.