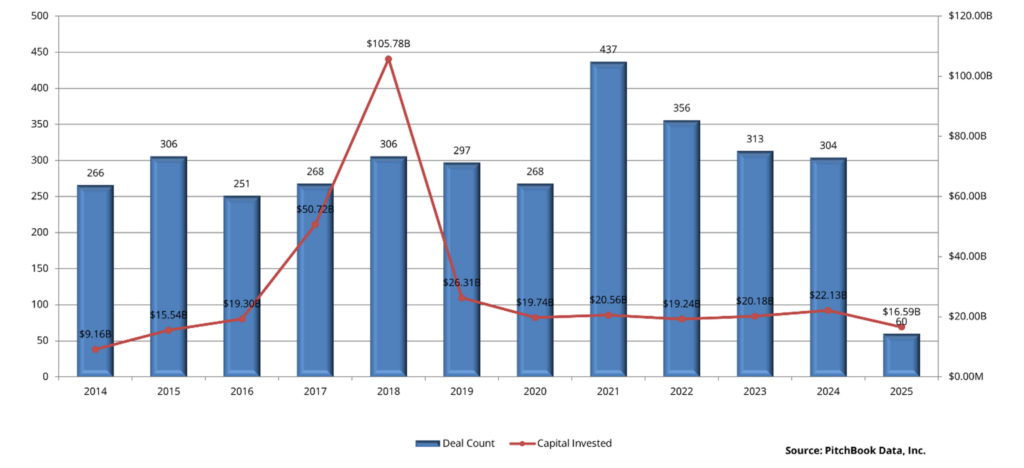

2024 M&A Deal Activity Flat with 2023 but Remains Strong Relative to Historic Levels

PitchBook Data reports 2024 global M&A deal activity within the Electronic Parts & Equipment sector was essentially flat with 2023. The chart below outlines that 304 deals were reported in 2024 vs. 313 in 2023. Capital Invested (Deal Value) on the other hand grew 10% to $22.2B in 2024 vs. $20.2B in 2023. A closer look at the past 4 years indicates the 2024 capital investment number was the highest deal value reported since 2019.

Despite increasing fears of recession, fundamentals still exist for healthy M&A activity. Private Equity investors still have more than $1 trillion to invest while large businesses with strong cash flows and balance sheets have not pulled back from strategic acquisitions. Year to date 2025 data suggests that 2025 is in fact off to a fast start with 60 deals reported for the first 2+ months of 2025 with a deal value of more than $16B. M&A activity remains strong relative to historic levels, which is especially notable during this time of uncertainty.

Electronic Parts & Equipment Deal History

Conclusion:

Our own buyer flow and transaction closing have remained strong, and we’ve seen no let-up in activity—making this an attractive time for owners of electronics businesses to explore their options. Whether you’re actively considering a sale or simply evaluating long-term plans, taking stock of your company’s readiness and understanding how the market might value your business can be a worthwhile step at any stage of ownership.

About the Author:

Charles Fay brings over 30 years of executive experience in high-tech electronics, including leadership roles in general management, sales, operations, supply chain, and distribution. His M&A work includes advising on the sale of companies across the industry, including those in networking and cybersecurity, UPS manufacturing, industrial products distribution, full-service electronics assembly, and printed circuit board manufacturing. Charles holds Series 79 and 63 licenses as a representative of StillPoint Capital.