admin

-

Introduction BMI has seen robust business acquisition activity from buyers and sellers in 2023, even though economic trends and credit availability remain uncertain. Our takeaway from all the data is that the positives outweigh the negatives, and while there are headwinds, the overall trend is one of strengthening. Companies holding steady Company financials reflect a…

-

In a recent appearance on The WealthChannel, Matt Tortora, Software & Technology Services M&A Advisor at BMI Mergers & Acquisitions, shared his expert insights on “How To Sell A Business With An Investment Bank” with host Andy Hagans. This interview provided crucial guidance and answers to vital questions for business owners contemplating the sale of…

-

BMI Mergers and Acquisitions was recognized by Axial, the largest platform on the internet for the lower middle market, as one of the top 50 dealmakers in software M&A. The article, titled “2023 Software M&A Market Outlook: Perspectives From The Top 50 Dealmakers” explores the current state of the software M&A market and features insights…

-

-

In 2022, the technology services M&A market had mixed results, with lower middle-market deal volume and valuations decreasing by 10-15% and 20-25%, respectively. However, downturns historically present attractive opportunities for strategic acquisitions, and compressed valuations may make many deals too good to pass up. In 2023, private equity firms are expected to be the primary…

-

The backlog of profitable jobs is a critical factor in determining the valuation of a construction business. While a company’s value is derived from various factors, such as financial performance and assets, a contractor with little work on its backlog is not attractive to potential buyers. The absence of a healthy backlog can lead to…

-

Despite the economic headwinds of higher interest rates and inflation, the construction sector continues to see steady merger & acquisition activity. Construction companies tend to sell for 3.5x to 7x EBITDA depending on the company’s size and other qualitative factors which can often be improved prior to selling. Here are ten actions an owner can…

-

Merger and Acquisition activity in the semiconductor industry is currently mixed due to regulatory and supply issues. While some companies are looking to acquire competitors to increase their market share and technological capabilities, others are holding off due to concerns about regulatory scrutiny and uncertainty around global supply chains.

-

The current state of the electronic components, equipment, and instruments industry. This report highlights the diversity of sub-industries that make up the sector and the growth opportunities created by the increasing importance of technology in different fields. Additionally, the challenges facing the industry, including supply chain disruptions and regulatory issues, and the impact of recent…

-

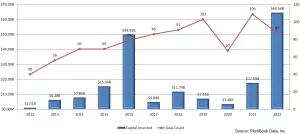

After a record-breaking performance in 2020 and 2021, the software M&A market is leveling off. Top of market valuation multiples of 10x to 12x ARR have all but faded, while deal volume in the tech sector appears to have softened by roughly 30%. Thank the economic slowdown. The rise of inflation has lowered prospects of…

-

BMI Mergers & Acquisitions, a leading middle market investment bank specializing in sell-side advisory, has been recognized by Axial as a Top 25 Lower Middle Market Investment Bank for the third quarter of 2022. This is the second time BMI has been recognized as a top investment bank in the past year. BMI’s Managing Partner,…

-

Over the past year, the federal government has passed legislation that will, directly and indirectly, affect manufacturing positively, and we believe it will be a supportive catalyst for further interest in US manufacturing deals. Download the full market report to gain insight into where Manufacturing M&A market is headed.