admin

-

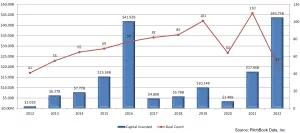

Construction M&A Deal Activity Slows In 2022 But Remains Healthy Construction-related deals for the first 8 months of 2022 totaled 498 which is a lower pace than 2021. However, as seen below, this is still a very healthy level of deal volume. In short, 2021 was an extraordinary year for M&A in every industrial sector,…

-

Chicago, IL – BMI Mergers & Acquisitions, a lower middle-market investment bank, announced the sale of its client, xTuple, an ERP software solutions provider, to CAI Software.

-

Harrisburg, PA – BMI Mergers & Acquisitions announces the confidential sale of a designer, producer, and wholesale distributor of premium-quality architectural moulding products to a New York-based investment company. BMI developed marketing materials, positioned the business to present to the market, located suitable buyers, worked with the company’s legal and financial advisors, and negotiated terms…

-

Philadelphia, PA – BMI announces the sale of a full-service electronics assembly manufacturing company in Connecticut to a Denver-based Private Equity Group. BMI worked with the seller to market the company, locate suitable buyers, and assist in the transaction negotiations and management. For more information, contact Charles Fay or Tom Kerchner.

-

M&A Deal Activity Slows In Q2 2022 But Remains Well Above Historic Levels Electronic Components, Equipment & Instruments – Market Report Deal volume: KPMG has concluded that after record M&A performance in 2021, both reported deal volume and deal value in the Industrial and Manufacturing sector declined 35% and 34% in Q1 2022. Leaders raised…

-

Heading into 2022, the market outlook for technology services M&A was initially strong, with businesses managing the shift to hybrid and in-person work environments and emerging technologies becoming more mainstream. However, the recent macroeconomic developments have dampened what were only months ago bullish expectations. Download the full report below to understand the outlook for M&A…

-

NEW YORK, NY – BMI Mergers & Acquisitions acted as exclusive M&A Advisor to Tomco Mechanical Corp., a leading mechanical services contractor, in connection with its sale to The Arcticom Group, a portfolio company of A&M Capital Partners. The transaction closed on May 31, 2022. Westbury-based Tomco Mechanical has a leading reputation for providing refrigeration…

-

Reeling from the widespread impact of the COVID-19 pandemic, software M&A has proven resilient in the face of a renascent pandemic, market volatility, rising inflation, and continued disruption to global supply chains. After a record-breaking year for software M&A in 2021, optimism for another supercharged year remains, despite potential market headwinds and geopolitical turmoil. Download…

-

Strategic fit and table stakes KPIs aren’t the only things acquirers evaluate during the software M&A process. A software code review is one of the many components that is often overlooked by sellers. Learn more about Matt Tortora.

-

CHICAGO, IL – Watermark, a leading provider of higher education insights software, announced the acquisition of Aviso Retention, a provider of an AI-powered student success solution. Founded in 2012 and headquartered in Columbus, OH, Aviso Retention enables colleges and universities to increase retention in addition to degree or certification completion. The company’s flagship solution, Aviso…

-

Many privately owned electronic businesses operating in the lower middle market can exhibit concentration in either the selling channel, the supply channel, or both. When the time comes to sell the business, what historically has been viewed as an area of strength by business owners can instead be considered a risk for potential buyers. Concentration…

-

There are over a dozen KPIs (key performance indicators) investors, and acquirers rely on when evaluating an investment or acquisition. Optimizing these metrics provides SaaS companies with a path to sustainable growth and puts them in a position to raise growth capital or successfully exit. This deck offers founders and CEOs an overview of what…