The quarterly IBBA and M&A Source Market Pulse Survey was created to gain an accurate understanding of the market conditions for businesses being sold. For fourth-quarter 2018, 319 business brokers and intermediaries participated in the survey. These advisors completed 273 transactions. This summary was created by BMI from the Market Pulse Survey.

VALUATIONS

The survey found 81% of respondents expect the current strong market to continue but end within two years with one-third saying the seller’s market will end within 12 months. Financing is readily available and strategic and private equity buyers are sitting on large amounts of capital available to deploy in acquisitions.

MULTIPLES STEADY SINCE 2016

| Transaction Value | 2018 Q4 | 2017 Q4 | 2016 Q4 | 2015 Q4 | 2014 Q4 | 2013 Q4 |

| $2MM-$5MM | 4.3 | 4.3 | 4.8 | 4.0 | 4.6 | 4.0 |

| $5MM-$50MM | 5.8 | 5.5 | 5.5 | 5.1 | 5.0 | 4.5 |

TIME TO CLOSE

Time to close has trended upward since 2013.

TIME TO CLOSE – 2018 vs 2013

| Transaction Value | Months to Close | LOI Months to Close | ||

| Q4 2013 | Q4 2018 | %Increase | Q4 2018 | |

| $1MM-$2MM | 6 | 9 | 50% | 3 |

| $2MM-$5MM | 8 | 10.5 | 13% | 4 |

| $5MM-$50MM | 10 | 12 | 10% | 4 |

| Avg. | 8 | 10.5 | 21% | 3.67 |

FINANCING – DEAL STRUCTURE

Financing continued to be readily available and this is expected to continue into 2019 with deals on average structured at about 80% cash at closing. Larger transactions involving private equity are more likely to include retained equity. Earn outs are more common on specific deals where uncertainty and risk prevent the parties from otherwise agreeing on a deal value.

AVERAGE DEAL STRUCTURES

| Cash at Close | Seller Financing | Earn Out | Retained Equity | |

| $1MM-$2MM | 83% | 10% | 2% | 1% |

| $2MM-$5MM | 78% | 10% | 3% | 4% |

| $5MM-$50MM | 82% | 11% | 2% | 3% |

MARKET SENTIMENT

83% of advisors indicated they expect a sellers market to continue but as noted above with an end in sight. This compares favorably to only 60% in Q4 201. This reflects the strong economy tempered by concerns as to how long the current expansion can continue.

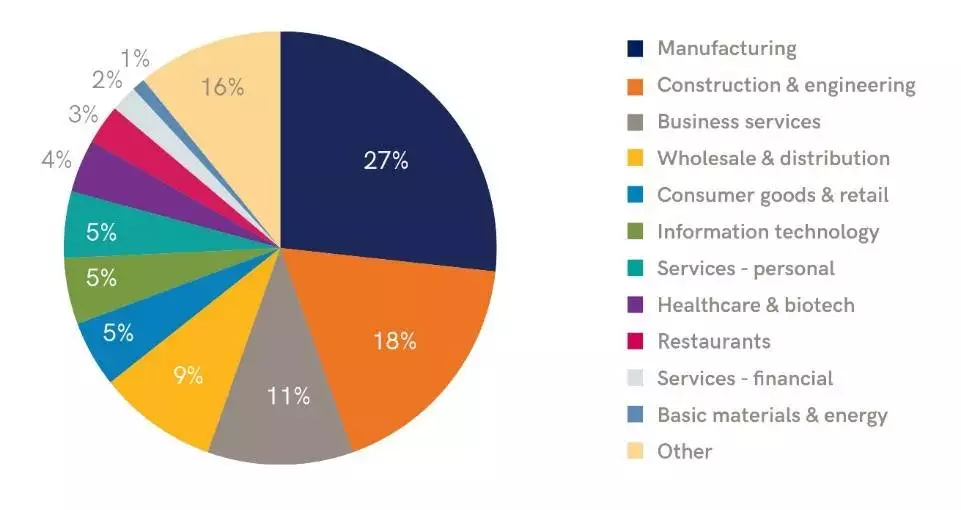

BUSINESS SALES BY INDUSTRY – SURVEY PARTICIPANTS

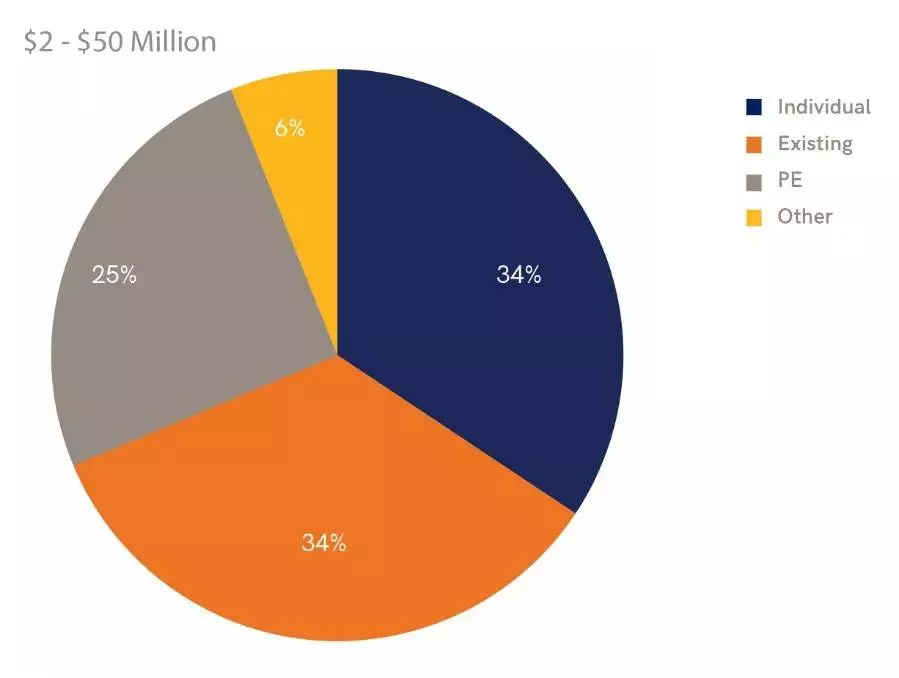

ACTIVE BUYERS IN $2 MILLION TO $50 MILLION TRANSACTIONS