Business Sales – Q4 2019 Market Pulse Survey Summary

The quarterly IBBA and M&A Source Market Pulse Survey was created to gain an accurate understanding of the market conditions for businesses being sold. For fourth quarter 2019 300 business brokers and intermediaries participated in the survey. These advisors completed 273 transactions. This summary was created by BMI from the Market Pulse Survey.

VALUATIONS

The survey found valuations for businesses remained at or above market peaks and ended the year on par with 2018. These historically high valuations are expected to continue into 2020 but no further increases are expected as we enter the tenth year of economic growth. Deal flow is expected to increase although deal closings are also expected to take longer and become more difficult.

MULTIPLES AT OR NEAR PEAK

| Median Multiple Paid (EBITDA) – All Industries | ||||||

| Transaction Value | 2019 Q4 | 2018 Q4 | 2017 Q4 | 2016 Q4 | 2015 Q4 | 2014 Q4 |

| $2MM-$5MM | 4.3 | 4.3 | 4.3 | 4.8 | 4.0 | 4.6 |

| $5MM-$50MM | 5.8 | 5.8 | 5.5 | 5.5 | 5.1 | 5.0 |

TIME TO CLOSE

Time to close has remained steady with a slight uptick attributed to additional volume and due diligence scrutiny over high valuations.

TIME TO CLOSE – 2019 vs 2013

| Transaction Value | Months to Close | LOI Months to Close | ||

| Q4 2013 | Q4 2019 | %Increase | Q4 2019 | |

| $1MM-$2MM | 6 | 9 | 50% | 3 |

| $2MM-$5MM | 8 | 9 | 13% | 3 |

| $5MM-$50MM | 10 | 11 | 10% | 4 |

| Avg. | 8 | 9.7 | 21% | 3.33 |

FINANCING – DEAL STRUCTURE

Financing continued to be readily available and this is expected to continue into 2020 with deals structured at about 80% cash at closing. Larger transactions involving private equity are more likely to include retained equity. Earn outs are more common on specific deals where uncertainty and risk prevent the parties from otherwise agreeing on a deal value.

AVERAGE DEAL STRUCTURES

| Cash at Close | Seller Financing | Earn Out | Retained Equity | |

| $1MM-$2MM | 80% | 14% | 2% | 1% |

| $2MM-$5MM | 80% | 15% | 4% | 1% |

| $5MM-$50MM | 82% | 11% | 2% | 3% |

MARKET SENTIMENT

75% of advisors indicated they expect a sellers market to continue. This is up from Q4 2013 where only 60% called the market in favor of sellers. As expected the larger companies enjoying a stronger sellers market than their smaller counterparts.

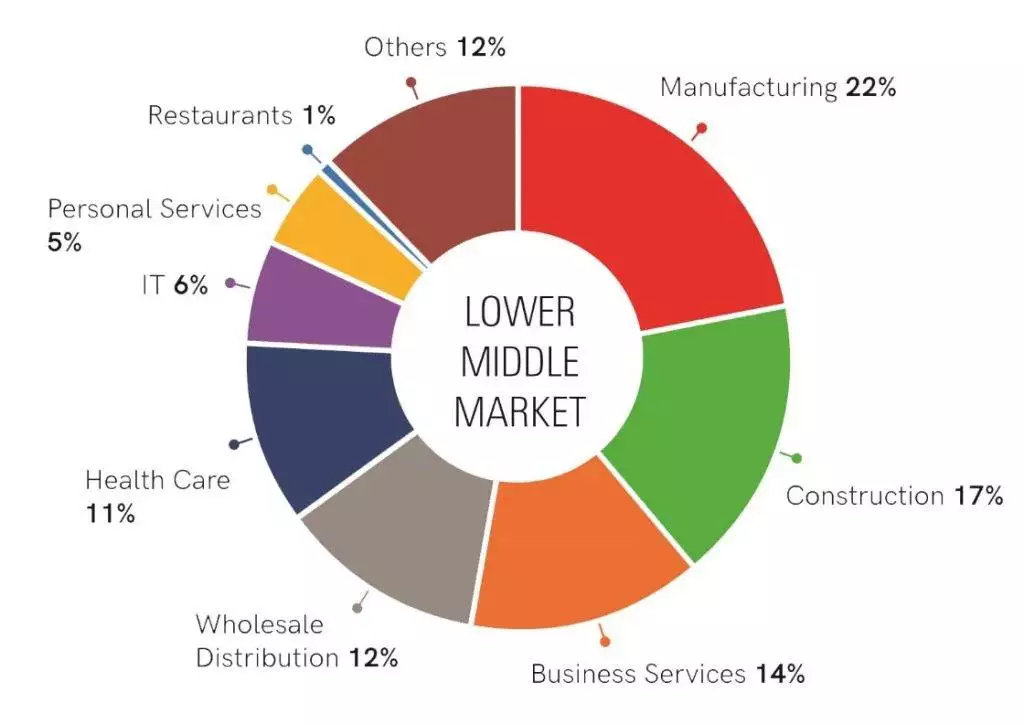

BUSINESS SALES BY INDUSTRY – SURVEY PARTICIPANTS

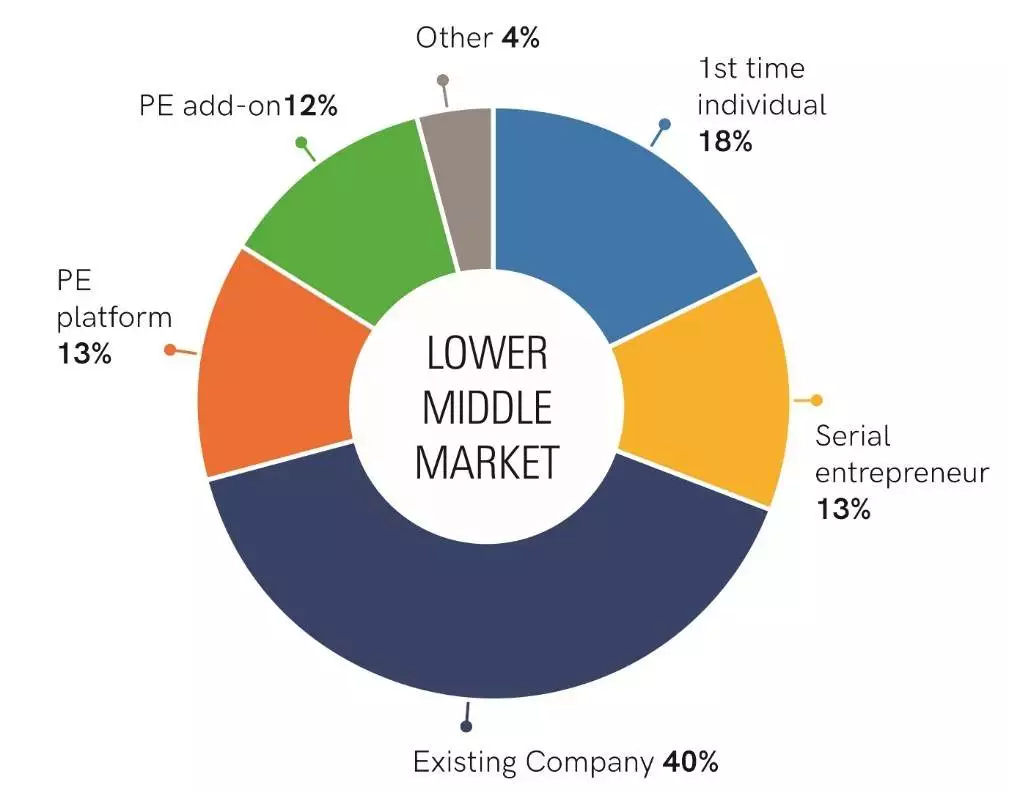

ACTIVE BUYERS IN $5 MILLION TO $50 MILLION