What is an Earn out?

In a business sale transaction, an earn out is a stream of future payments that are contingent on the achievement of some future benchmark or criteria. For example, a simple earn out might look like this: “If total revenue exceeds $10,000,000 in the next calendar year, then seller shall be paid an additional $50,000 for every $500,000 in excess of $10 million.” Earn outs are often based on income or revenue however any measurable criteria could be used such as customer retention, employee retention, supplier retention, contract or regulatory approval and more. While usually earn outs are assumed to arise from differences in opinion of value, they can also be used where both parties agree that future results or events may be at risk. In such cases an earn out can take away the value killing aspect of perceived risk.

How often are Earn outs utilized in business sale transactions?

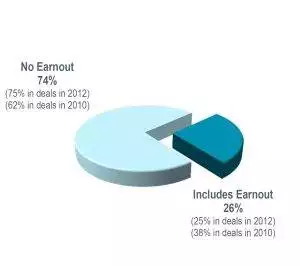

The 2015 ABA Private Target M&A Deal Points Study1 of deals with transaction values between $17 million and $500 million showed that 26% of deals included some type of earn-out component. Comparable to the 25% of the prior year. This is a decline from the 38% reported for 2010 when there was much more uncertainty in the market.

Looking at the Pepperdine Private Capital Markets Project Market Pulse Surveys2 which looks at smaller transactions we see only about 5% of deals between $1 million and $50 million have an earn out component. Clearly larger deals are more likely to have an earn out. More importantly, having a sound reason and basis for an earn out is key to obtaining value and avoiding problems.

Reasons for Earn outs when buying or selling a business

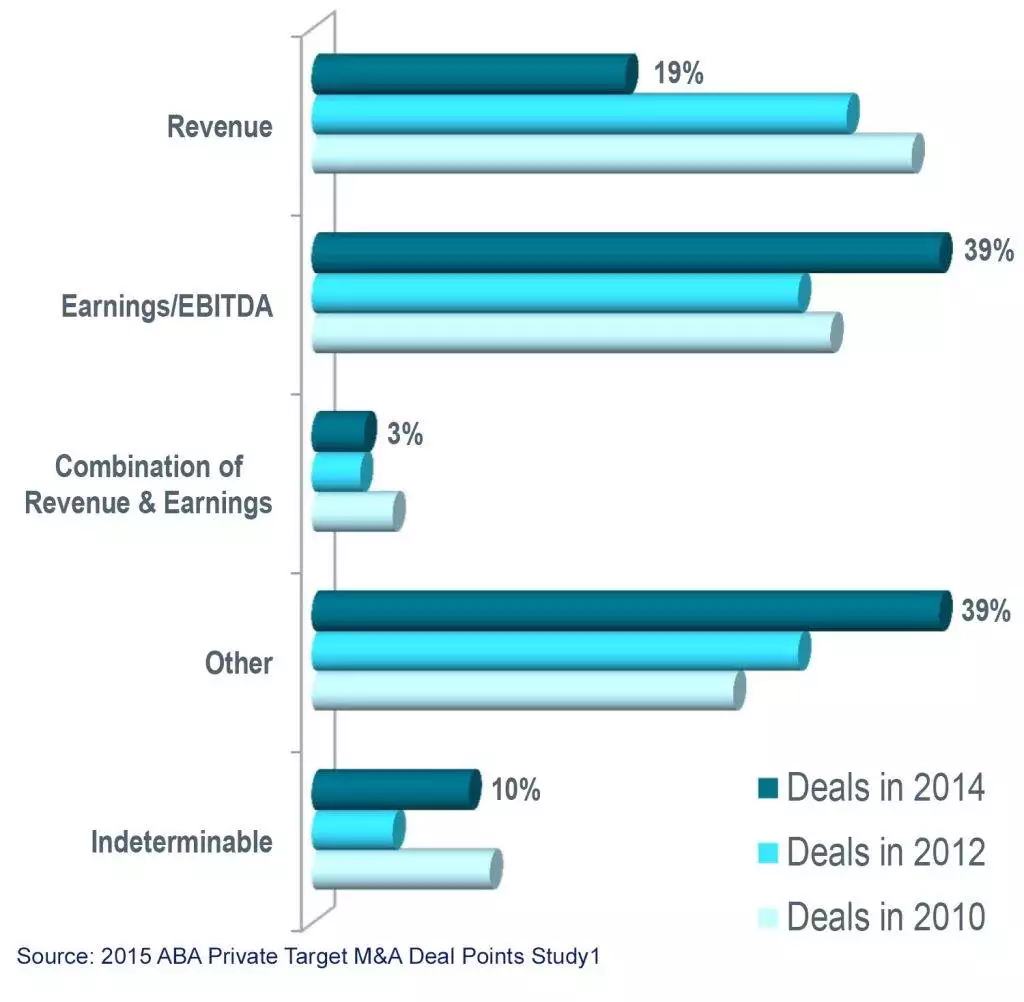

Often it is said that earn outs arise from differences in opinion of value between a business buyer and seller. This may be true, but raw differences in opinion of value are rarely bridged by earn outs. A buyer will not agree to pay more than they think the business is worth regardless of the mechanism for making the payments. What really seems to underlie most earn outs is differences in perceived risk. Risk is a key component of valuation and it is the component which can often be addressed with an earn out. As you can see, in the chart below from the ABA study, the majority of earn outs are based on revenue or income.

A sizable number of deals have an earn out based on something other than income or revenue. Outlined below are the potential reasons (some good, some not) to incorporate earn outs in a deal structure.

- Difference in value – as noted above this generally has something to do with differences in perceived risk. Where both parties agree on the basics of the business and industry, and the seller thinks the market is 6x ebitda and a buyer wants to pay based on a 5x multiple (i.e. a higher discount rate) an earn out might not bridge the gap. If however, the difference is due to perceptions of risk and the buyer is building that risk into their valuation model, it’s possible an earn out will bridge the gap.

- Capital Investment – seller has made a significant investment in capital equipment with the expectation of increased revenue and/or income but the benefits of the project have not been realized by the time of the transaction. In these cases it is important that the assumptions used by the seller when making the investment are still relevant to the buyer.

- New Customer / Contract / Regulatory Approval – developing new customers and contracts or obtaining regulatory approval to sell a new product can take years of work. Understandably the seller wants to be compensated for laying the groundwork. The buyer may agree but wants to see results before paying. The direction the seller was heading when pursuing these projects must be a direction the buyer agrees with. An example would be a seller that has been developing a new channel of distribution for its products. A buyer who may be bringing their own products and distribution to the deal may see potential channel conflicts and not be willing to pursue the sellers strategy. A seller with multiple buyer options can select the buyer based on aligned visions and the overall best value taking into account the likelihood of future earn outs.

- Future Growth – this could simply be a company in high growth mode and the buyer is uncertain current levels and growth rates are sustainable. Since no one can perfectly foresee the future an earn out can bridge the gap where growth rates are uncertain.

- Pending Government Legislation – recently in Pennsylvania, the state government announced a major realignment of the program for managing the assignment of state funded clients to the various home care agencies. This involves inserting managing care associations between the state and the care givers. While some agencies believe this will ultimately be good for business no one is certain and there is thinking that this could be bad for the smaller agencies. Transactions undertaken while this program is rolled out may be prime for inclusion of earn outs.

- Customer or Supplier Concentration – an otherwise solid company will have difficulty attracting its requisite value if too much revenue is tied to any one customer. Buyers will say, “ If the business loses that customer the profits will be decimated and I will have over paid for the business.” The seller of course points out that the customer has been around a long time and isn’t likely to go anywhere if the buyer continues the sellers approach. We have seen where the seller is usually correct, however we have also seen where a major customer was acquired, during due diligence and the acquirer immediately started putting pressure on the high margin products. An earn out kept the deal on track and everyone has been satisfied with the results. Less common but similar issues could arise around supplier concentration, particularly where the supplier options are limited.

- Defer Taxes – depending on the size of the individual payments, an earn-out can help reduce taxes for the sellers. Generally this should not be a primary reason for an earn out although it can be a factor in a pro-con analysis.

- Reduce Buyers cash outlay, debt service and risk – depending on the buyers situation, there could be good reasons for a buyer to need an earn out to make the deal structure work for them. The problem here is that it shifts more risk to the seller. In cases where there are multiple bidders to buy a business, the low bidders or the least financially secure bidders will often offer high earn outs. These generally should be avoided as they only benefit the buyer and are a means to avoid paying fair value at closing. Well considered earn outs offer something to both sides.

- Keep the Seller Engaged – where a seller is key to the current success of the organization, perhaps thru customer relationships, the buyer will want to keep the seller involved and have a financial interest in the company’s success after the business is sold. These can be structured in a variety of ways but typically they are based on top line revenue, gross profit, operating income or specific customer or employee retention.

Earn outs can be employed to account for future upside potential or as a risk management/reduction for potential downsides. Whatever the reason, constructing the earn out takes thoughtful consideration of a multitude of variables.

Considerations Before Agreeing to an Earn Out

There is a natural discord between two principles of earn outs – 1) keep them simple and 2) define them adequately to avoid future disputes. Businesses, industries and economies are complex, full of variables and difficult to predict. From a simplicity standpoint, revenue as a criteria is a much simpler choice than ebitda. Revenue is usually straightforward and subject to only a few internal and external variables. EBITDA on the other hand is the net after all the operating expense line items which leave a lot of variables to go wrong or be impacted by the buyers actions. Whichever criteria is used, you may want to carve out new expenses added by the buyer. For instance, private equity groups typically charge their portfolio companies a management fee. Other expenses added by buyers such as additional sales people may be more problematic to avoid as these may actually have a positive impact on the earn out.

One of the major contributors to success is the quality and ability of the buyer. Regardless of the structure of the earn out a certain amount of trust in the buyer is necessary. They will be controlling the business and therefore selecting the right buyer and getting to know that buyer is paramount. Attempts to control the buyers actions in order to guarantee the earn out usually fail because buyers do not want to have their hands tied. Buyers typically want to grow the business and make investments in people, processes and equipment that could temporarily reduce income. It is rare to find a buyer that is willing to have its actions severely restricted. Restrictions or required actions can be successfully included where the buyer and seller completely agree on the direction and the mandate is relatively narrowly drawn. At rare times broad clauses are added that state the buyer will run the business consistent with past practice however this occurred in only 3% of the deals in the 2015 ABA Private Deals M&A Survey. This is down considerably from 2010 when 27% of deals had this covenant. This makes sense in that in 2010 the economic direction was less certain, earn outs were more common, probably larger and therefore more of the deal hinged on the earn out. Buyers knew they could be buying at temporarily deflated prices and were more willing to consider this restriction.

How the earn out is structured can determine whether the earn out payments are considered part of the purchase price and taxed at the capital gains rate with the federal max currently 23.86% or considered compensation and taxed up to 39.6%. First criteria to look at is whether the seller(s) will be involved in the business during the earn out period. The less involvement the more likely the payments will be treated as purchase price. Even if the seller is employed, if the seller is compensated for their time and services separate from the earn out, this too could qualify as purchase price. Earn outs that look more like compensation for services may include language that tie the earn out to continued employment or varies based on the efforts of the seller. When drafting an earn out, you should seek the advice of a tax professional familiar with the tax aspects of earn outs.

Where a company will be merged with another entity post closing, the business sale transaction may not be a good candidate for an earn out except for situations with very specific and narrowly defined criteria such as the retention of a specific customer. Broader categories such as revenue and income could be problematic to track post closing and could result in disputes.

A component of earn outs is the post closing tracking and reporting requirements and information sharing. Sellers will want to have the ability to request financial reports, have access to personnel and generally be able to verify the results relevant to the earn out. All of this should be discussed between buyer and seller in a series of in depth discussions about the current status and future expectations of the company. Included of course is developing mutually agreeable understandings of how the earn out will work. Ideally an M&A advisor or other third party should be present to assure both sides truly have a common understanding. There have been situations where meetings took place without the benefit of a third party advisor and both sides thought they had a common understanding only to discover later that each party saw things quite differently. Once the business points have been agreed upon, the transaction attorneys will be important players in developing the language governing the earn out and striking an appropriate balance between completing a successful deal and mitigating their clients risk.

Constructing the Earn Out

The effort put in up front in structuring an earn out will impact the likely success and minimize the likelihood of disputes in the future. In summary, here are 7 steps to constructing an earn out.

- Determine the underlying reason for the earn out. A difference in valuation could be the general driver but likely there is a specific reason why valuations differ between buyer and seller.

- Select the appropriate metric. If a customer’s contribution to profits is the concern, then gross profit may be a better measure than revenue. A buyer will not want to pay an earn out based on low margin business.

- Define how the business and ultimately the earn out will be controlled. Will the seller have a significant role or will the buyer be the sole driver? Are there specific tasks, investments or milestones that must be instituted in order for the earn out to be possible? If the metric is based on income will certain expenses added by the buyer be excluded?

- Determine how the metric will be measured and paid. For instance, if revenue based, how will returns and bad debt be counted and how does this affect the timing of the calculations and payments.

- Layout the reporting and verification requirements that will be used to give the seller the ability to understand the actual earn out payments. Will the books be available for periodic review? Will financial statements be reviewed or audited and will the earn out calculations be performed by the buyer or an independent third party.

- Outline how disputes will be resolved. Typically this is done thru a mutually agreed independent CPA firm, but sometimes the disputes go beyond accounting and have more to do with intent which then enters the legal world. An arbitration procedure may reduce the need for expensive litigation.

- Finally, document all discussions between buyer and seller having to do with the earn out. These notes can go a long way in first assisting the attorneys in constructing a mutually agreeable earn out and second helping to resolve future disagreements. Ideally a third party advisor will take care of documenting the discussions.

Summary

Earn outs can be a good solution and aid in completing business sale transactions where a buyer and seller both want to work together and there are legitimate valuation or business concerns. Earn outs should be carefully considered and constructed to maximize potential success. Doing so adds value for both business sellers and buyers.