Insights

-

Manufacturing company valuations are often discussed in terms of multiples of EBITDA. This is because EBITDA is a common measure of a company’s cash flow that allows apples-to-apples comparisons between companies with different capital structures. We looked at manufacturers sold in the past five years, included breakouts for a few key manufacturing sectors, and summarized…

-

Strategic fit and table stakes KPIs aren’t the only things acquirers evaluate during the software M&A process. A software code review is one of the many components that is often overlooked by sellers. Learn more about Matt Tortora.

-

Many privately owned electronic businesses operating in the lower middle market can exhibit concentration in either the selling channel, the supply channel, or both. When the time comes to sell the business, what historically has been viewed as an area of strength by business owners can instead be considered a risk for potential buyers. Concentration…

-

There are over a dozen KPIs (key performance indicators) investors, and acquirers rely on when evaluating an investment or acquisition. Optimizing these metrics provides SaaS companies with a path to sustainable growth and puts them in a position to raise growth capital or successfully exit. This deck offers founders and CEOs an overview of what…

-

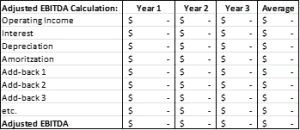

EBITDA is an abbreviation for “earnings before interest, taxes, depreciation, and amortization.” It is calculated by taking operating income and adding back to it; interest, depreciation, and amortization expenses. EBITDA is a key metric widely used by financial and investment professionals operating in the lower-middle market to analyze a company’s operating profitability and estimate valuations.…

-

Many private businesses survived the pandemic crisis of 2020 and have now stabilized, but for others, the perfect storm is still raging. How can business owners ensure the survival of their businesses and the ultimate positioning of their business for sale? Questions many business owners are asking BMI advisors: The good news is that demand…

-

SBA Rules for PPP Loans in Business Ownership Changes Many M&A transactions since April 2020 have involved a PPP loan held by the selling company. Parties have often been unsure of the impact of a sale or partial sale on the forgiveness of the loan. On October 2, 2020, the SBA issued rules for business…

-

I often speak with CEOs and business owners in the IT services space who are beginning to think about an eventual exit plan but are still a few years out from starting that process. And the question I am often asked is “What are buyers looking for, and how can I best prepare for a…

-

Monday, August 17, 2020 – (Chicago, IL) – BMI Mergers & Acquisitions, an M&A and business brokerage firm, announced Matthew Tortora successfully completed the exams and requirements for the FINRA series 79 (Investment Banking Representative) and 63 (Uniform Securities Agent State Law) registrations. This brings an additional level of professionalism and protection for his clients…

-

What Doesn’t Kill You Makes You Stronger When will the market for private business sales rebound? Small business owners who were planning to transition ownership and retire in the next few years are losing sleep over fear that they missed the market. The truth is, private equity groups and other buyers still have plenty of…

-

Three Stages to Navigating from Crisis to Success Three to six months of cash to cover business expenses? That ship may have sailed, but it’s not time to panic, it’s time to make a plan. Many business owners have succeeded by trusting their gut, but this is not the time to wing it: it’s time…

-

Acquirers of electronics manufacturers will pay more for certain types of businesses and will be more attracted to companies when they are properly described. Thus, the correct use of industry terminology can be an important part of marketing and selling your electronics business. Background The term OEM stands for “original equipment manufacturer”. Some years ago,…