Market Reports

-

Over the past year, the federal government has passed legislation that will, directly and indirectly, affect manufacturing positively, and we believe it will be a supportive catalyst for further interest in US manufacturing deals. Download the full market report to gain insight into where Manufacturing M&A market is headed.

-

Construction M&A Deal Activity Slows In 2022 But Remains Healthy Construction-related deals for the first 8 months of 2022 totaled 498 which is a lower pace than 2021. However, as seen below, this is still a very healthy level of deal volume. In short, 2021 was an extraordinary year for M&A in every industrial sector,…

-

M&A Deal Activity Slows In Q2 2022 But Remains Well Above Historic Levels Electronic Components, Equipment & Instruments – Market Report Deal volume: KPMG has concluded that after record M&A performance in 2021, both reported deal volume and deal value in the Industrial and Manufacturing sector declined 35% and 34% in Q1 2022. Leaders raised…

-

Heading into 2022, the market outlook for technology services M&A was initially strong, with businesses managing the shift to hybrid and in-person work environments and emerging technologies becoming more mainstream. However, the recent macroeconomic developments have dampened what were only months ago bullish expectations. Download the full report below to understand the outlook for M&A…

-

Reeling from the widespread impact of the COVID-19 pandemic, software M&A has proven resilient in the face of a renascent pandemic, market volatility, rising inflation, and continued disruption to global supply chains. After a record-breaking year for software M&A in 2021, optimism for another supercharged year remains, despite potential market headwinds and geopolitical turmoil. Download…

-

The SaaS sector aced its first major test in 2020 this proving its resiliency. In the early months of the pandemic, M&A came to an unprecedented halt as the world shut down. However, by the second half of the year, the buyer confidence and deal-making soared to record highs, resulting in some of the largest…

-

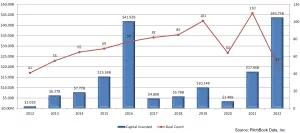

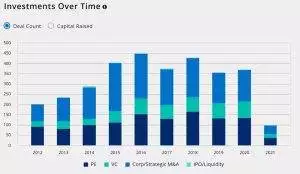

The $342B software development and digital transformation market is expected to grow by 15% + annually over the next several years. And subsequently, many companies are looking to capitalize on that growth via acquisitions making for a very active M&A market in this space. The fallout from the COVID-19 pandemic has only accelerated the urgency…

-

Despite Covid-19, 2020 was a solid year for deals for both medical and non-medical home care companies and things look to be heating up as deal flow in 2021 is outpacing recent years.

-

After Technology Services deal activity rose in 2019 reaching a ten-year high, the M&A market slowed in 2020, largely due to the global COVID-19 Pandemic. Heading into 2021, the global technology services market is expected to grow to over five trillion dollars, which represents a growth rate of 4.2% as the economy rebounds from the…

-

Overview Acquisition activity in the IT services space is strong heading into 2020. A broad base of both strategic and financial buyers are paying attractive valuation multiples for companies that offer the right fundamentals. For business owners exploring the possibility of selling their organization understanding market dynamics in terms of both valuation multiples and characteristics…

-

M&A Source Market Pulse Survey was created to gain an accurate understanding of the market conditions for small businesses being sold with values $0-$2MM and the lower middle market (values $2MM -$50MM). The national survey was conducted with the intent of providing a valuable resource to business owners and their advisors. The IBBA and M&A…