News

-

In a recent appearance on The WealthChannel, Matt Tortora, Software & Technology Services M&A Advisor at BMI Mergers & Acquisitions, shared his expert insights on “How To Sell A Business With An Investment Bank” with host Andy Hagans. This interview provided crucial guidance and answers to vital questions for business owners contemplating the sale of…

-

BMI Mergers and Acquisitions was recognized by Axial, the largest platform on the internet for the lower middle market, as one of the top 50 dealmakers in software M&A. The article, titled “2023 Software M&A Market Outlook: Perspectives From The Top 50 Dealmakers” explores the current state of the software M&A market and features insights…

-

In the past two years, we saw a peak in valuations and deal volumes in the market, creating a seller’s market where deal terms were favorable. As we move into 2023, the macro-economic picture remains relatively strong, but interest rate increases and global events may create uncertainty. Buyers, especially private equity firms, are still actively…

-

BMI Mergers & Acquisitions, a leading middle market investment bank specializing in sell-side advisory, has been recognized by Axial as a Top 25 Lower Middle Market Investment Bank for the third quarter of 2022. This is the second time BMI has been recognized as a top investment bank in the past year. BMI’s Managing Partner,…

-

Construction M&A Deal Activity Slows In 2022 But Remains Healthy Construction-related deals for the first 8 months of 2022 totaled 498 which is a lower pace than 2021. However, as seen below, this is still a very healthy level of deal volume. In short, 2021 was an extraordinary year for M&A in every industrial sector,…

-

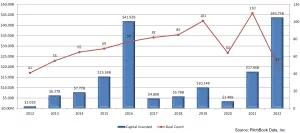

Down, Not Out M&A activity in the solar industry dipped 24% during the first two quarters of 2022. However, there are three reasons we believe the slowdown is a short-term phenomenon versus a more concerning long-term trend. Download the full market report to learn more.

-

Chicago, IL – BMI Mergers & Acquisitions, a lower middle-market investment bank, announced the sale of its client, xTuple, an ERP software solutions provider, to CAI Software.

-

Harrisburg, PA – BMI Mergers & Acquisitions announces the confidential sale of a designer, producer, and wholesale distributor of premium-quality architectural moulding products to a New York-based investment company. BMI developed marketing materials, positioned the business to present to the market, located suitable buyers, worked with the company’s legal and financial advisors, and negotiated terms…

-

Philadelphia, PA – BMI announces the sale of a full-service electronics assembly manufacturing company in Connecticut to a Denver-based Private Equity Group. BMI worked with the seller to market the company, locate suitable buyers, and assist in the transaction negotiations and management. For more information, contact Charles Fay or Tom Kerchner.

-

M&A Deal Activity Slows In Q2 2022 But Remains Well Above Historic Levels Electronic Components, Equipment & Instruments – Market Report Deal volume: KPMG has concluded that after record M&A performance in 2021, both reported deal volume and deal value in the Industrial and Manufacturing sector declined 35% and 34% in Q1 2022. Leaders raised…

-

NEW YORK, NY – BMI Mergers & Acquisitions acted as exclusive M&A Advisor to Tomco Mechanical Corp., a leading mechanical services contractor, in connection with its sale to The Arcticom Group, a portfolio company of A&M Capital Partners. The transaction closed on May 31, 2022. Westbury-based Tomco Mechanical has a leading reputation for providing refrigeration…

-

CHICAGO, IL – Watermark, a leading provider of higher education insights software, announced the acquisition of Aviso Retention, a provider of an AI-powered student success solution. Founded in 2012 and headquartered in Columbus, OH, Aviso Retention enables colleges and universities to increase retention in addition to degree or certification completion. The company’s flagship solution, Aviso…