M&A Deal Activity Continues Quarterly Decline but Remains Strong Relative To Historic Levels

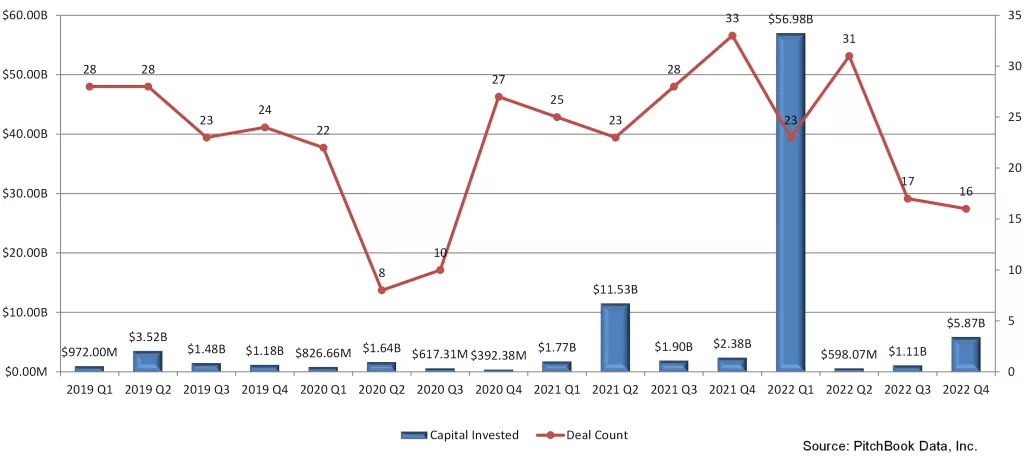

PitchBook reports Q3 global M&A activity continued to decline for the third consecutive quarter falling 29.8% in deal value from the peak seen in Q4 2021. Global deal count is a similar story. Q3 announcements slowed both in terms of deal count and deal value by 7.4% and 26.3% respectively.

In July of this year, we reported that deal count in the electronic component, equipment and instrument sector was yielding similar but less tepid results. As shown in the two charts below PitchBook data for this sector now indicates the performance in this sector is similar to what we are seeing globally as Q3 deal count has dropped 45% from 31 to 17.

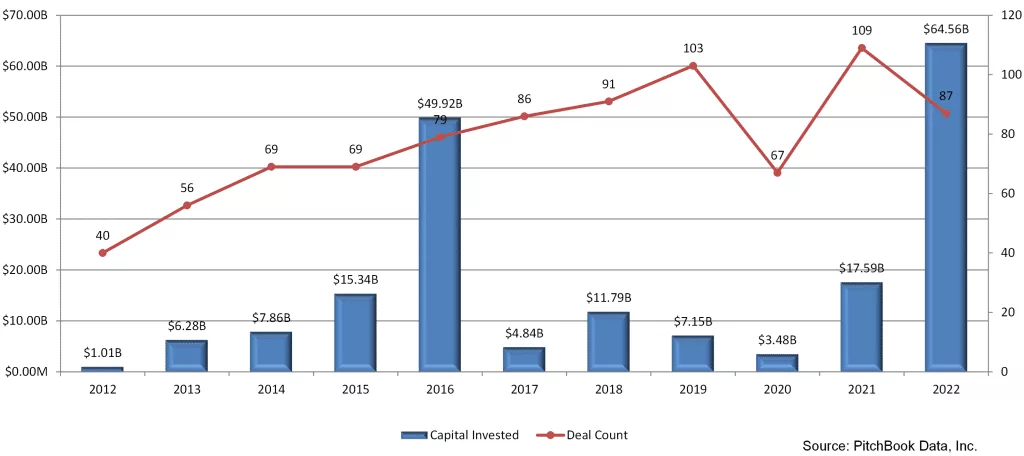

Despite increasing fears of recession, fundamentals still exist for healthy M&A activity. PE investors still have more than $1 trillion to invest. Large businesses with strong cash flows and balance sheets have not yet pulled back from strategic acquisitions. Deal count may continue to slow as investors become conservative. All that said M&A activity remains strong relative to historic levels which is especially notable during this time of intense volatility.

Selected Q3/Q4 Strategic Transactions: Note 53 deals announced YTD

- Rogers Corporation, a manufacturer of materials and components previously reached a definitive agreement to be acquired by DuPont de Nemours (NYS: DD) for $5.2 billion. The deal is in line with DuPont’s aim to expand its portfolio of advanced electronic materials used in areas such as smart and autonomous vehicles and fifth-generation telecommunications. The deal was however canceled on Nov 1, 2022 as the companies have been unable to obtain timely clearance from required regulators.

- Ouster (NYS: OUST), a manufacturer of high resolution lidar sensors and Velodyne Lidar (NAS: VLDR) reached a definitive agreement to form the Merger of Equals (Ouster / Velodyne) on November 4, 2022. The combined company will have a broader customer base, partners and distribution channels, coupled with reduced production costs.

- Audio Analytics, a developer of sound recognition software was acquired by Meta Platforms (NAS: META) for an undisclosed amount on November 6, 2022.

- Malema Engineering, a manufacturer of measurement and control instruments was acquired by Dover (NYS: DOV) for approximately $225 million on July 5, 2022. The company will receive a contingent payout of $50 million dependent on the achievement of certain financial objectives over a two-year period. The acquisition enables Dover to expand its biopharma single-use production offering and further strengthens its sensor portfolio with new proprietary technology.

- Vesper, a developer of piezo electric microphone products for smart phones was acquired by Qualcomm (NAS: QCOM) for $160 million on August 31, 2022.

Selected Q3/Q4 Private Equity Transactions: Note 34 deals announced YTD

- Omega Engineering, a manufacturer of industrial measurement equipment and a subsidiary of Spectris, was acquired by Dwyer Instruments, via its financial sponsor Arcline Investment Management, through a $525 million LBO on July 5, 2022. Following the acquisition, Dwyer Instruments will reap benefits from highly complementary product offerings and a scaled platform within shared markets.

- SOMACIS an Italian manufacturer of high-performance Printed Circuit Boards (PCB’s) was acquired by Chequers Capital through an LBO on September 28, 2022 for an undisclosed amount. The transaction was supported by debt financing in the form of a loan from Banca Ifis, Banca Nazionale del Lavoro and Credit Agricole Entreprises.

- Swift Motion a developer of wearable sensors entered into a definitive agreement to be acquired by Ninth Street Capital Partners through an LBO on October 6, 2022 for an undisclosed amount. This transaction will enable the company’s products to reach more enterprises while accelerating further development and also enables to expand its product offerings addressing the need for more insights into workplace injuries.

- DuraComm Power Supplies a manufacturer of switching power supplies entered into a definitive agreement to be acquired by Ninth Street Capital Partners through an LBO on October 6, 2022, for an undisclosed amount. This transaction will enable the company’s products to reach more enterprises while accelerating further development.