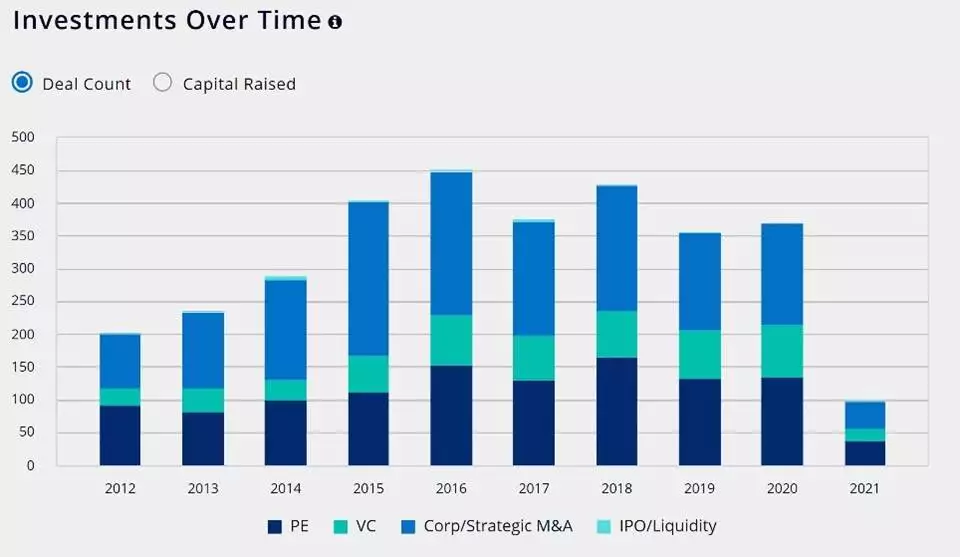

Home Health Care market transaction pace in 2021 is ahead of 2020 and 2019. Despite Covid-19, 2020 was a solid year for deals for both medical and non-medical home care companies, and now things look to be heating up as deal flow so far in 2021 is outpacing recent years.

Buyers have been consistently outnumbering sellers on quality businesses, and in 2021 this looks to be even more so, giving potential seller’s options for choosing their partner. Deals are happening across all types, including medical, non-medical, private pay, and Medicaid/Medicare, but we see more activity in the medical and private pay sectors. Some buyers tend to avoid purely non-medical Medicaid businesses due to lower margins and single-payer risk; however, even these companies are attracting serious attention. Some of these companies are well run and generate respectable margins; therefore, buyers are giving these a look. This segmentation of the home care industry – medical vs. non-medical vs. private pay vs. Medicaid/Medicare results in wide-ranging valuations with more variability in agency valuations relative to other segments in the healthcare industry. For example, in the 10-25 million deal range, the reported valuations in Home Health Care Services were twice as variable as other sectors such as Physicians Offices and Outpatient Care Centers.

Deals in 2021 so far run the gamut from new private equity buying independent operators, private equity buying franchise systems, hospital systems divesting home health, and traditional non-medical providers expanding into medical home care and hospice. Mission Healthcare, Tennant, Traditions Health, and Caring People have all made more than one acquisition so far in 2021.

| Acquirer/Buyer Type | # Deals YTD 2021 |

| Total Reported Transactions | 30 |

| Strategics | 12 |

| Strategics Owned by Private Equity | 13 |

| Private Equity | 5 |

| Total with Private Equity Involvement | 18 |

| Agencies Sold – Non-Medical Home Care Only | 5 |

| Agencies Sold – Medical Home Health Care Only | 9 |

| Agencies Sold – Non-Medical – Medicaid Only | 1 |

Owners of home care agencies are looking ahead to negative factors that could impact their value. First and most frequently mentioned by business owners is the potential for increases in corporate and capital gains taxes. This is creating a push to get deals done in 2021 in the hopes that any tax increases don’t take effect until 2022. Other factors, particularly for the smaller agencies in certain states, are the demands of EVV and the increasing power of managed care organizations. This is creating more rollup opportunities for the large strategics, although we still expect 2021 to be a seller’s market. On the plus side, owners can see demand for at-home care increasing as Covid-19 highlighted the risks and shortcomings of assisted living facilities. Even before Covid-19, Medicare Advantage opened up eligibility for plans to cover non-medical home care services.

Agency owners have a bright future in the home care industry and may not want to hit the exits yet, but for those that do, 2021 looks to be an excellent year to do so.