Buyer Interest Heating Up

Pace of M&A Activity Expected to Resume

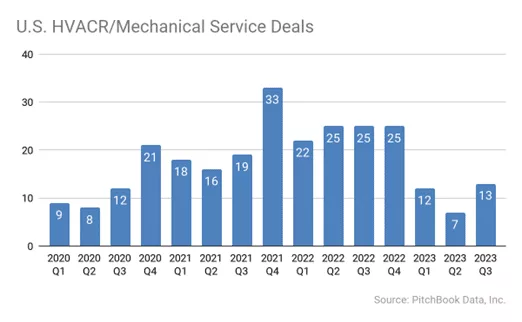

After an M&A boom driven by a private equity buying frenzy that peaked in Q4 2021, U.S. HVAC/Refrigeration and other mechanical and facility service providers have seen an M&A slowdown so far in 2023. BMI sees demand heating up again after a cooling off period resulting, in large part, from higher interest rates and integration of recent purchases. Some buyers have stayed on the sidelines due to frothy valuation multiples but are ready to step back in as valuations reach more reasonable levels.

Platform Strategies Continue to Drive Deal Activity

Dozens of HVAC/R and facility services platform companies have been launched by financial buyers in recent years, usually focused either on commercial/industrial facilities or residential/light commercial customers. In the commercial space, platform strategies include broadly defined field services, commercial facility services, and MEP (mechanical, electrical, plumbing) groups. Becoming part of a larger group can bring up to date technology to smaller contractors, improving efficiency by implementing new ERP systems, giving management real-time visibility into their business operations to improve financial planning and forecasting. It also offers sharing of best practices and peer groups among group companies, with more leadership opportunities for talented team members.

Strategic Buyers Step into the Breach

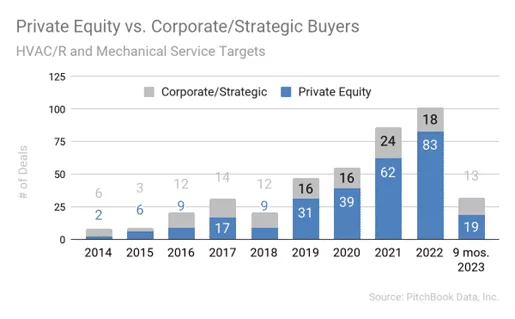

This cooling off period has led to an increase in M&A interest from strategic buyers who use acquisitions to strengthen their businesses and generate synergy. Many tell us they felt they were left on the sidelines, and now there’s an opportunity for them to buy solid businesses from their founders at more reasonable valuations. As shown below, strategic buyers bought 41% of deals in the sector in the first 9 months of 2023, compared to only 18% in the year 2022.

Realizing the Value of Your Life’s Work

For most private business owners, the company is their main financial asset, and a sale is often the best way to realize that value for retirement and estate planning. Owners of HVAC/R and other mechanical service businesses tell us they receive cold inquiries from potential buyers regularly, and we encourage them to engage an advisor who knows the industry and players when they’re ready to consider an exit. It is essential to create a competitive process to achieve the highest valuation and negotiate the most favorable deal structure. In many private equity acquisitions, business owners or their senior managers may roll over a portion of their equity into their new parent company, gaining “another bite of the apple” down the road as the platform grows and the value is realized. The structuring and valuation of rollover equity is complex and requires an experienced M&A advisor, as well as specialized legal and tax advice.

Financial Buyers Seek Recurring Revenue; Corporate Buyers Seek Profitable Growth

In the commercial HVAC and mechanical service space, some financial buyers shy away from installation and construction, focusing on contractors offering field service, repair, and retrofit with less than 50% new installation work. This is mainly due to the desirability of recurring revenue, reducing cyclicality. Large public projects with bonding requirements and unionized shops may also turn off some financial buyers. Instead, they seek contractors with a defensible competitive advantage who can help build density in existing territories and serve national accounts. However, corporate buyers have signaled their interest in acquiring construction-focused contractors which may lead to preventative maintenance contracts and repair opportunities.

Predictable Revenue Streams and Sustainable Margins Drive Buyer Demand

HVAC, refrigeration, building controls, fire protection, foodservice equipment, and other mechanical services are viewed as mission critical, a true partnership between client and contractor. We expect the intense competition for these deals to continue, particularly for contractors with a strong backlog and established customer relationships. One buyer told us, “Deal activity has been slow year-to-date as we’ve been working to integrate prior acquisitions, but our pipeline is full and we expect to close several deals before the end of 2023.”

The Best is Yet to Come

According to Private Equity Info, the median holding period for private equity-backed portfolio companies has been increasing and is now 5.6 years. Since many private equity investors have an investment horizon of 4 to 6 years, we expect to see a lot of contractor platforms coming to market in 2024 – 2026. Business owners seeking liquidity shouldn’t fear they’ve missed the market: buyers still have a strong appetite. Buyers are still looking to fill out capabilities in existing markets and help serve national accounts, rather than taking a scattershot approach. In a recent Pitchbook interview, Goldman Sachs’ chief credit strategist Lotfi Karoui predicted a return to the leveraged buyout in 2024: “record amounts of dry powder paired with more deals financed with equity and cash will stimulate a return to a traditional LBO structure.”

If you would like to discuss these insights and how they may impact your own M&A plans, please get in touch with Jane Marlowe.