BMI’s electronics team brings decades of global operational, leadership, and acquisition experience in the electronics manufacturing and distribution sectors. We have successfully guided numerous transactions for electronics manufacturers and parts distributors, leveraging our deep industry knowledge and expertise to ensure favorable outcomes for our clients.

Electronics

Electronics M&A Team

Charles Fay

Charles experience encompasses working with companies such as Arrow Electronics, Texas Instruments, GE, Flextronics, IBM Schlumberger, Siemens, Broadcom, Alcatel and Dell. His work has included numerous acquisitions of manufacturing and distribution electronics companies and the sale of companies including circuit boards, assemblies, defense electronics, communications, batteries, and medical instruments. Charles has also authored several articles on M&A in the electronics industry.

Tom Kerchner

Tom leads BMI’s overall M&A practice and has worked on hundreds of transactions including circuit board manufacturers, controls, defense communications and batteries. He has over 35 years of M&A experience ranging from the lower middle-market up to $1 billion with a particular emphasis on manufacturing and distribution companies.

Notable Transactions

AmeriNet

Sold to:

Falcon Electric, Inc.

Sold to:

Automation Systems Interconnect

Sold to:

Niche Electronics

Sold to:

Tridex Technology

Sold to:

Precision Graphics

Sold to:

LSI

Sold to:

What Our Clients Say

“BMI showed what it was truly worth to potential buyers, identifying multiple qualified buyers, and ultimately receiving an offer from the best firm.”

John Martinelli – President, Tomco Mechanical Corp.

“BMI did extensive market research. Their assistance in evaluating the many offers received helped us maximize value.”

Dan Stern – Tridex Technology

“Thank you for finding the ideal buyer for our company that will allow Niche to continue to grow.”

Jim Riggs – Niche Electronic Technologies

Insights & Resources

BMI Mergers & Acquisitions Advises AmeriNet Inc. in Sale to Virtual Guardian, a Division of ESI Technologies

BMI Mergers & Acquisitions Advises Falcon Electric on Acquisition by Avnan Capital Ltd.

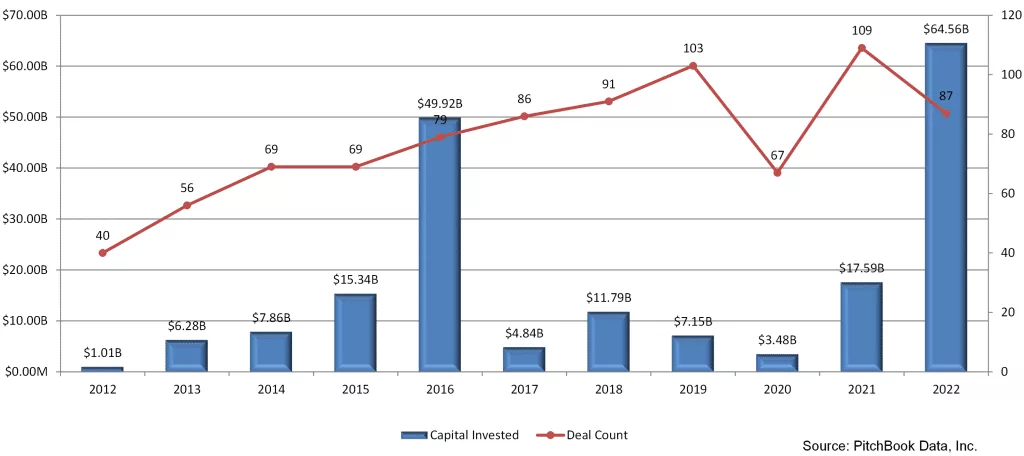

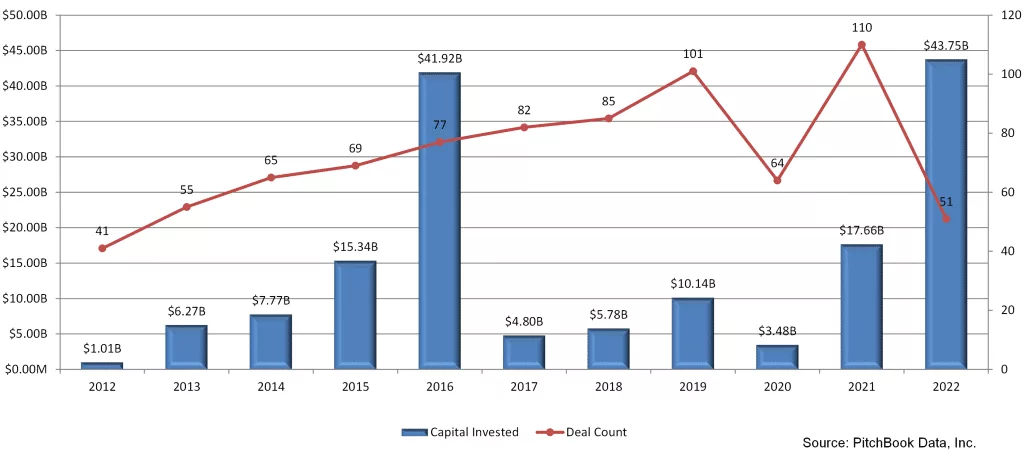

Semiconductor 2022 M&A Deal Activity Mixed Amid Regulatory and Supply Issues

Q4 2022 Electronic Components, Equipment & Instruments Deal Activity

U.S. Solar M&A Market Report H1 2022

Q2 2022 Electronic Components, Equipment & Instruments Market Report

Concentration Can Significantly Impact Valuations For Lower Middle Market Electronic Businesses

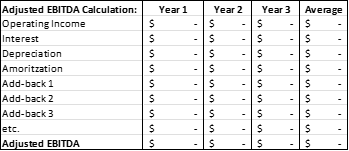

Add-Backs To EBITDA Can Substantially Increase Business Valuations

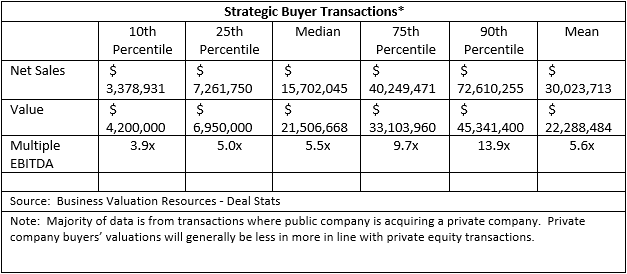

Valuations – Electronic Product Manufacturing