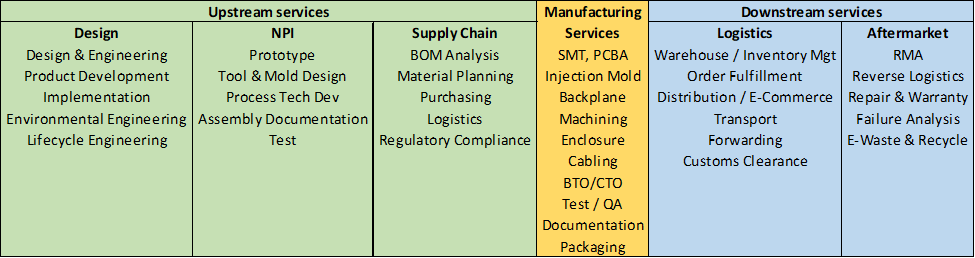

With over 120 collective years in manufacturing and distribution M&A, BMI Mergers & Acquisitions has advised on a broad range of transactions across sectors like consumer products, food, metals, recycling, electronics, industrial equipment, and medical devices. Our deep industry expertise includes key areas such as metal products, machine shops, injection molding, and fabrication. Leveraging our knowledge of market dynamics, we guide companies through complex transactions, helping them achieve optimal outcomes and maximize value.

Manufacturing & Distribution

Manufacturing & Distribution M&A Team

Charles Fay

Charles has over 30 years and over 100 transactions in the electronics industry. M&A experience includes electronics, machine tools and industrial products. Previous industry experience included Texas Instruments, Arrow Electronics as well as a private pharmaceutical and electronics manufacturers.

David Olson

David manufacturing/distribution experience includes metals fabrication, machining, plastics, and beverage. He has over 20 years of management consulting experience, specializing in CEO Business Coaching for top-line growth, emphasizing Strategy, Sales & Marketing, Culture, and Leadership.

Paul Cocco

Paul’s M&A experience ranges from food production to metal fabrication, equipment manufacturing, industrial furnaces and building products. Paul was a marketing/sales leader and lead cross functional product teams at Hershey Foods as well as owner of a battery distribution and recycling business.

Jane Marlowe

Jane headed the North American Industrials Strategic Advisory team in the NY office of Dresdner Kleinwort, where she worked with Fortune 500 corporations as well as mid-cap companies. Her industrials experience includes machinery, construction, medical devices, security, instrumentation, distribution, business services, and automotive.

Tom Kerchner

Tom’s experience includes 30 years buying, selling, integrating, and operating various manufacturing and distribution businesses in the U.S. and Europe. Expertise includes batteries, electronics, metals, plastics, recycling, equipment, fabrication and machining, industrial furnaces, industrial contracting and more.

Notable Transactions

Engineered Resin Solutions

Sold to:

K. Wagner Machine Inc.

Sold to:

William A. Schmidt & Sons

Sold to:

Superior Iron Works, Inc.

Sold to:

Bardot Plastics, Inc.

Sold to:

SmitHahn Company

Sold to:

Ecco/Gregory, Inc.

Sold to:

ATI Corporation

Sold to:

OSDA

Sold to:

What Our Clients Say

“BMI was very experienced in the buy/sell transaction industry. They were very professional, listened to our concerns, and advocated solutions on our behalf. We are really glad we went to the Union League presentation and then worked with BMI through the process. “

Mike Chiarlone – Owner, Byrne Chiarlone LP

“BMI was very professional. They did a good job marketing, vetting offers, developing buyers who were serious purchasers, and handled the negotiation and due diligence phase very well. “

Don Byrne – Owner, Byrne Chiarlone LP

“Another firm failed to obtain a single offer; BMI was able to generate a successful LOI within 60 days of going to market. The sale was completed within 180 days of engagement.”

John B. – Business Owner

“BMI did extensive market research. Their assistance in evaluating the many offers received helped us maximize value.”

Dan Stern – Tridex Technology

“We have nothing but great things to say about Paul Cocco and BMI. Our experience was awesome. “

Darcy DiFazio – Owner, Allegheny Store Fixtures

- 1

- 2

Insights & Resources

Injection Molding Market Recap for 2024

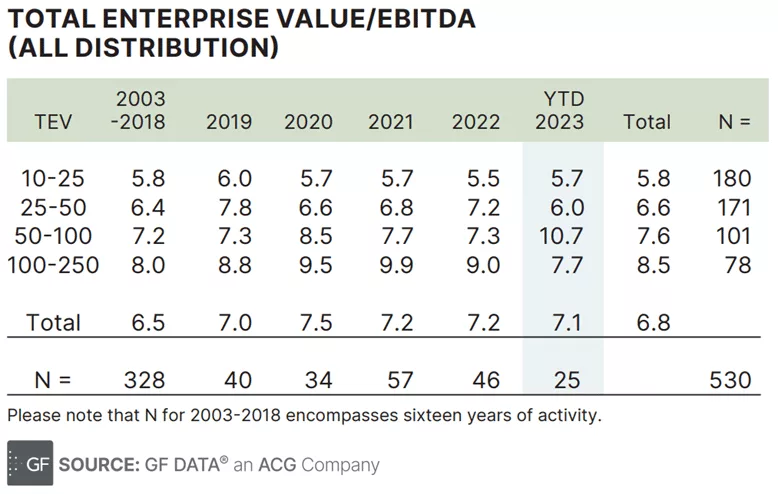

2023 Review: Distribution M&A Valuations

2023 Business Acquisitions: The Middle Market M&A Outlook

Q3 2022 Manufacturing M&A Market Report

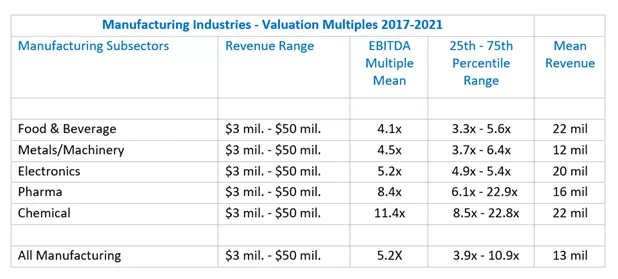

Valuation Multiples for the Manufacturing Industry

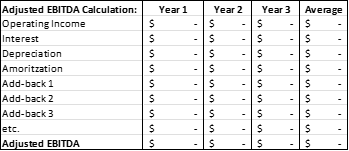

Add-Backs To EBITDA Can Substantially Increase Business Valuations

BMI Targeted Acquisition Program Leads to Growth in Wisconsin

Planning to Sell Your Business in a Time of Uncertainty

Business Acquisition and Valuation in Electronic Manufacturing: Correct Terminology Matters