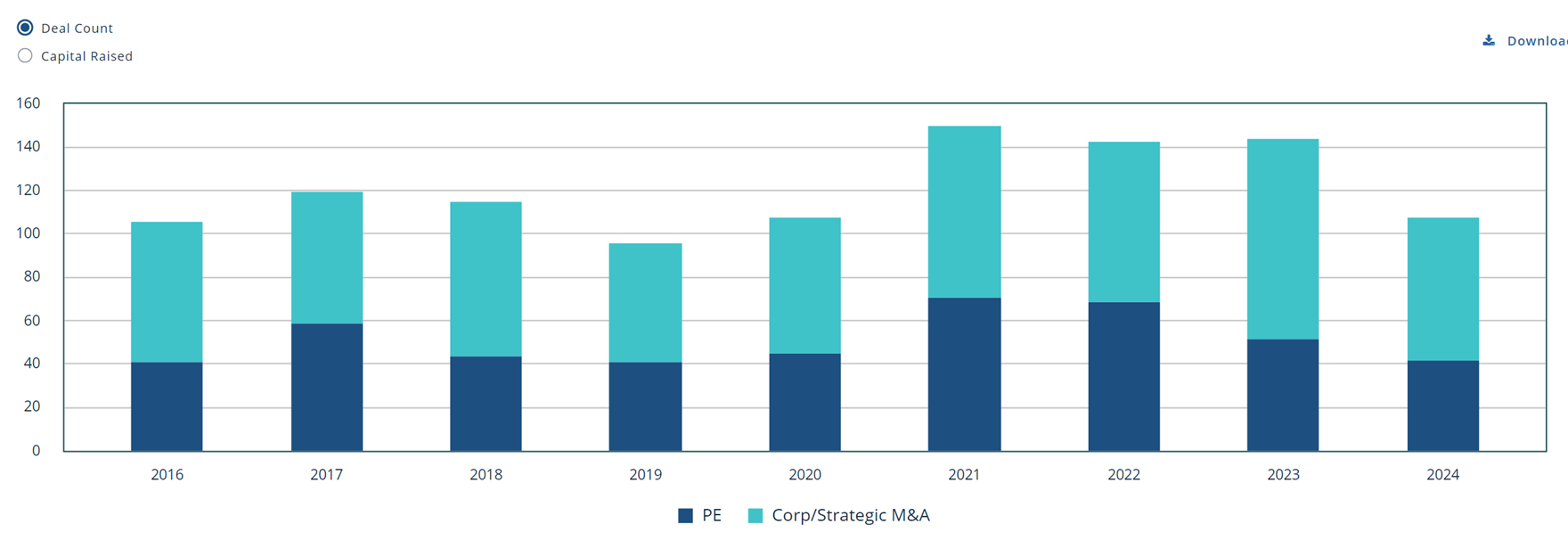

Injection Molding M&A trends in 2024 show deal activity returning to pre-pandemic levels of 2019, though still below the post-COVID highs of 2021-2023. Strategic buyers remain dominant, but the lines continue to blur as many private equity firms own the strategics driving these investments.

Deal Count – 10 Year History – Injection Molding

VALUATIONS – INJECTION MOLDING

Valuations seem to be holding steady with previous years although deal terms continue to be affected by higher interest rates as the number of all cash deals has declined from 2022. Here is what we see:

INJECTION MOLDING VALUATIONS

| EBITDA RANGE | VALUATION MULTIPLE |

|---|---|

| Under 1 mil | 3-4x |

| 1-3 mil | 4-6x |

| 3-5 mil | 5-7x |

| 5-8 mil | 5-9x |

Transaction value = EBITDA x Valuation Multiple

Example: $2 million EBITDA business x 5x multiple = transaction value of $10 million.

Reasons for the range of values include many non-financial factors. For instance molders with their own branded products will get higher valuations than the typical contract molder. Other factors include the strength of their customers markets, strength of their management teams and customer concentration.

SAMPLING OF DEALS FROM 2024:

Brewster Plastics NY, a non-industry specific molder, acquired by Celltreat Scientific Products – a manufacturer of laboratory plastic consumables. The acquisition increases Celltreats domestic production capabilities.

Knightsbridge Plastics of CA acquired by Viant, backed by 3 PEGS. Knightsbridge is a producer of small to medium size tight tolerance parts. This acquisition increases Viants ability to produce highly specialized plastic injection molded parts.

Plastone of Finland was acquired by KB components. The acquisition strengthens KB Components’ product portfolio and is a valuable addition to its business area ‘Medical technology.

Proactive Plastics, an injection molder in Phoenix AZ, was acquired by Singapore based Sunningdale Tech and their financial sponsor, Novo Tellus Capital. This adds the US to Sunningdale Techs manufacturing footprint in southeast Asia and Mexico.

OUTLOOK FOR 2025

Most forecasters predict industry growth globally of between 4 and 5% with the US at a 3-4% range. This growth is primarily from consumer goods, electronics, packaged food and electric vehicles. Although more growth is expected in the Asia-Pacific region, US demand is also positively impacted by a continuing movement of supply chains into or closer to the US market. BMI found demand for injection molders to be high in 2024 and with overall M&A prospects expected to improve in 2025, we see demand for injection molders to be healthy in 2025.