M&A Deal Activity Slows In Q2 2022 But Remains Well Above Historic Levels

Electronic Components, Equipment & Instruments – Market Report

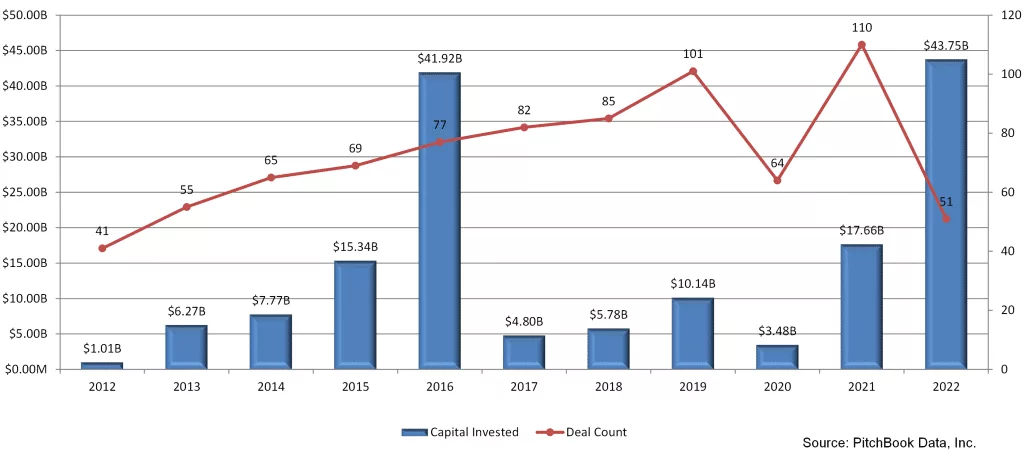

Deal volume: KPMG has concluded that after record M&A performance in 2021, both reported deal volume and deal value in the Industrial and Manufacturing sector declined 35% and 34% in Q1 2022. Leaders raised concerns regarding ongoing material shortages, increased labor costs, labor shortages, rising interest rates, and the fear of recession. However, a close inspection of the electronic component, equipment, and instrument sector illustrates deal volume has moderately declined but remains at historic high levels. As shown in the charts below, PitchBook Data for this sector indicates that after 10 years of steady M&A growth (2020 excluded), the 51 deals reported for the first 6 months of 2022 are on pace to decline 7% from the record 110 deals reported in 2021 and flat with the 101 deals reported in 2019.

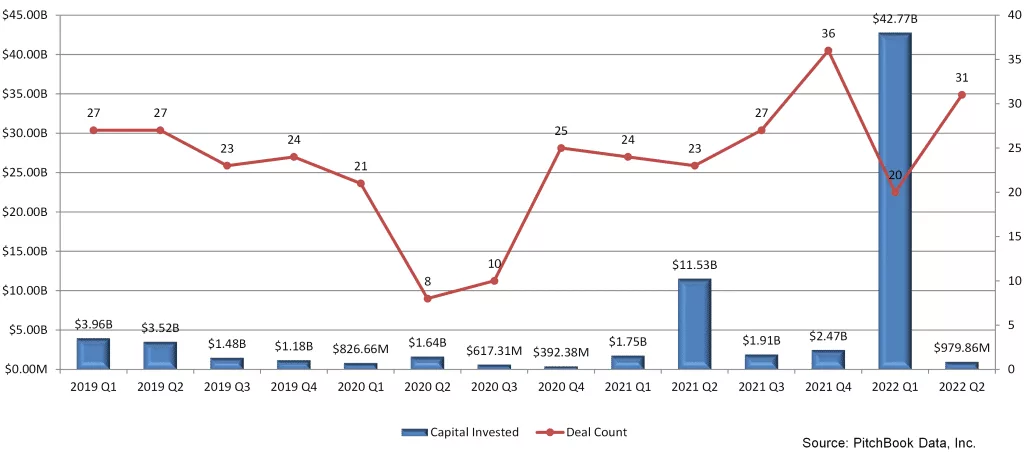

The second chart illustrates 14 consecutive quarters of data from Q1 2019 thru Q2 2022. Results are mixed. On the one hand, the deal count increased from 20 reported in Q1 2022 to 31 announced in Q2 2022. However, deals reported in the first 6 months of 2022 declined 19% from the 63 reported in the final 6 months of 2021.

Deal Value:

At first glance, the $55 billion deal value reported in Q1 2022 marked an incremental increase over the Q4 2021 value of $14 billion. However, closer inspection indicates that $40 billion of the Q122 transaction value is attributed to the not yet completed ARM acquisition by Sk Hynix, the South Korean memory producer. At the time of this writing, Sk is seeking investment partners, and the transaction is not yet complete. With the ARM transaction removed, the value of Q1 2022 transactions totaled $14.95 billion, which is 5% above Q4 2022 and more than 3x higher than Q1 2022.

What does the future hold?

Will deal activity continue to decline, or might we see a reversal? No one knows for sure. What we do know is that electronic component, equipment, and instrument manufacturers face rising but similar concerns. On one hand, pessimists may delay and shop for bargains, while optimists may seize opportunities. We do believe that companies will redouble efforts to strengthen supply chains. The war between Russia and Ukraine will present further challenges for semiconductor chip makers and serve to exacerbate an industry that has been facing critical capacity and material shortages for more than 2 years. Nevertheless, we believe some of these changes will lead to more mergers and acquisitions.

Key strategic transactions:

| # | Acquirer | Target Name | Target Business | Value |

| 1 | SK Hynix | ARM | Application Specific Semiconductors | $40 billion |

| 2 | ST Engineering | TransCore | Electronic Toll Collection | $2.68 billion |

| 3 | Sivers Semiconductors | MixCom | Application Specific Semiconductors | $255 million |

| 4 | CCL Industries | RFID Hotel | RFID Key Cards | $27.9 million |

| 5 | Viper Networks | Eco Tech Solutions | Printed Circuit Boards | $1.7 million |