Overview

Acquisition activity in the IT services space is strong heading into 2020. A broad base of both strategic and financial buyers are paying attractive valuation multiples for companies that offer the right fundamentals.

For business owners exploring the possibility of selling their organization understanding market dynamics in terms of both valuation multiples and characteristics acquirers are seeking is helpful in shaping realistic expectations and planning a future exit.

Who’s Buying

Established lower middle market firms with revenues of $5M to $100M are benefiting from an abundance of capital that private equity groups and established strategic buyers currently have. While selling to a private equity firm offers a very logical fit for many, strategic buyers have been actively seeking acquisition opportunities in the lower middle market as well. It’s also important to note that less obvious strategic acquirers in complementary industries are targeting many IT services firms in an effort to increase their solutions offerings and talent base.

For smaller firms with revenues of $1M to $5M the private equity route is typically not an option. However strategic acquirers and private buyers often are evaluating companies in this range for the value they can provide in the form of strong development talent, IP, and recurring revenue streams.

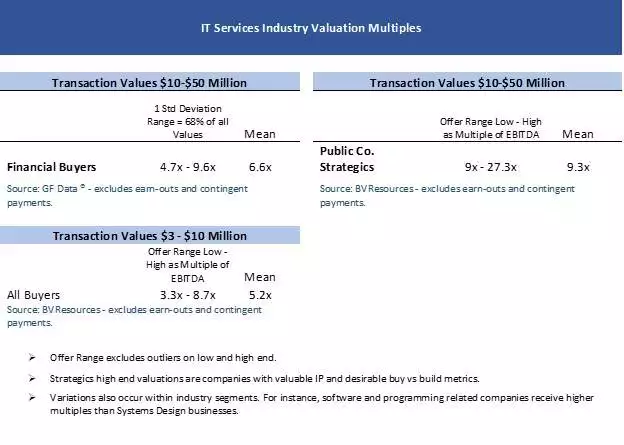

Valuation Multiples

When reviewing this data, it’s important to note that there is a wide range of company, acquirer, and deal specific factors that can have a significant impact on valuations. Key determinants for the highest valuations include above average financials, recurring revenue models, scalability and intellectual property uniqueness. As noted on the chart on the following page, the size of the company and type of buyer are also important determinants.

KPIs & Valuation Drivers

When assessing acquisition opportunities, in addition to top line revenue acquirers rely heavily on 2-3 years’ worth of financial KPIs including; EBITDA, gross margin and annual growth rate. While these variables are relevant in most acquisitions, they play an even bigger role in valuation multiples when financial buyers are involved.

Strategic acquirers have driven the majority of deal volume in the mid-market (~90%) over the past several years. And they have also shown a propensity to pay slightly higher multiples. While the aforementioned financial KPIs are still important, strategic acquirers are also taking several variables into consideration when searching for and valuing acquisition targets.

- Ability to add complimentary services offerings and expertise.

- Opportunity to tap into new markets and customer bases.

- Ability to add development talent through an acquisition especially as it relates to emerging technologies.

- Strength and experience of management team.

“Hot” technologies where consulting and development talent is at a premium has been an area of focus for both financial and strategic acquirers and is subsequently driving higher valuation multiples. These include; cyber-security, AI, IoT and connected systems, and advanced analytics.

Adjacent Industries

While larger IT services firms seem like the most obvious strategic acquirers, companies in adjacent industries have been actively acquiring IT services firms. Management consulting firms, media agencies, and professional services organizations focused on specific business processes have been acquiring IT services firms that present a logical strategic fit.

Opportunities To Enhance Value

While good business fundamentals lay the foundation for a successful exit there are several opportunities for IT services firms to capture added value and increase their desirability in the eyes of potential acquirers.

Recurring Revenue: Acquirers are increasingly seeking IT services firms with an established and growing line of recurring revenue. Recurring revenue will increase scalability, customer lifetime value, and gross margins all key variables when assessing company valuation

Intellectual Property: Developing intellectual property in the form of technology goes a long way in creating greater efficiency and a competitive advantage. The move by many firms to a technology enabled services model has not only created operational advantages but also long-term value.

Points of Differentiation: The IT services space is an immensely crowded one littered with “me too” offerings. Establishing points of differentiation and a sustainable competitive advantage aide in both long-term growth and perceived business value.

Conclusion

Companies contemplating an exit in 2020 should see valuations continue the strong performance in 2018 and 2019. Those companies with the strongest fundamentals will command premium value and most quality businesses will also likely find a good market in 2020.