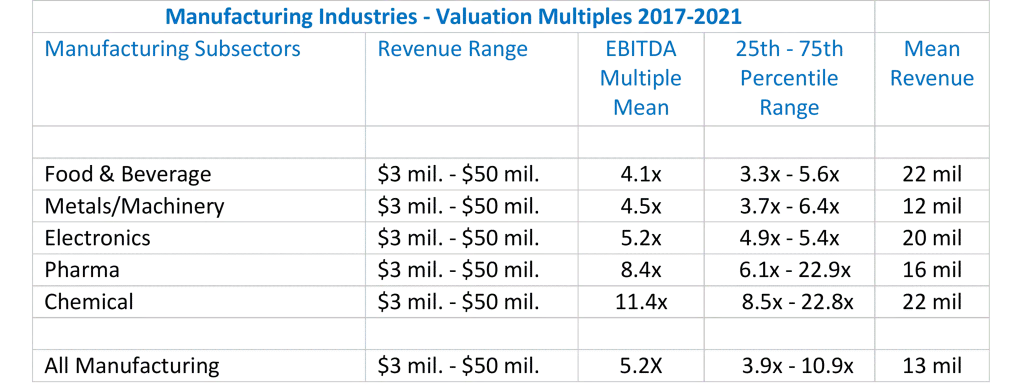

Manufacturing company valuations are often discussed in terms of multiples of EBITDA. This is because EBITDA is a common measure of a company’s cash flow that allows apples-to-apples comparisons between companies with different capital structures. We looked at manufacturers sold in the past five years, included breakouts for a few key manufacturing sectors, and summarized these below.

Note the difference in valuations between chemical manufacturers and food and beverage manufacturers. Specific industries tend to have higher valuations, particularly those with unique technology or processes. However, there can be sub-sectors with very high valuations, even with a relatively low-value industry. For example, certain specialty ethnic foods have commanded very high valuations within food manufacturing, sometimes in the mid-teens.

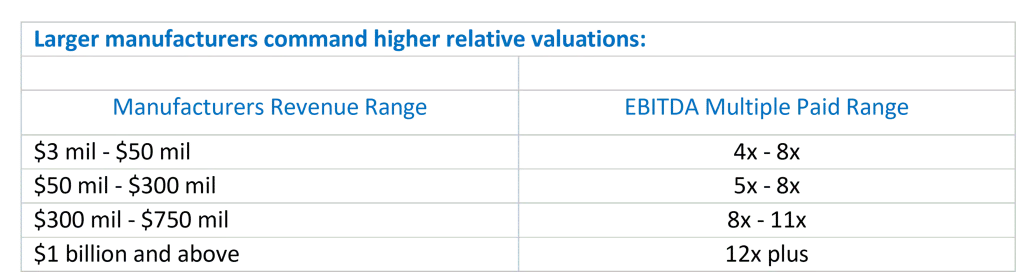

When valuing a business using EBITDA multiples, care must be taken to evaluate all aspects of the company and apply the correct multiplier. The first criteria to always be considered is the company’s size, both in terms of revenue and EBITDA. The chart outlines that larger companies generally sell for higher valuation multiples. The reason is very simple – larger companies have less risk. Another variable is the EBITDA to use. Many companies are coming off of record-high EBITDAs for 2021. Buyers will evaluate the sustainability of those results and may use a more conservative 3 or 4-year average.

Not all buyers are the same, and it shows in their valuations as we consistently see a 50% range between the low and high offers. This is due to buyers having different risk profiles, synergies, or opportunities for financial engineering. For instance, private equity buyers are generally more conservative than strategics but even private equity groups are paying higher premiums on quality manufacturing businesses.

Besides company size and buyer specifics, there are six key factors affecting a manufacturing businesses value:

- Quality of Financials

- Solid Management Team

- Low Customer Concentration

- Well Managed Working Capital

- Niche Market or Unique Intellectual Property

- Reasonable Capital Expenditure Requirements

Manufacturing multiples have been relatively steady over the years, although there has been an increase in later years as the economy continues to expand. Owners of manufacturing businesses looking to sell will face an eager market of buyers. Valuations can vary widely, and therefore shareholders’ expectations should be informed by carefully considering the factors laid out here and consulting with their advisors.

About The Author

Tom Kerchner is Managing Director of BMI and has worked on business sales and acquisitions for all of his careers. He has over 35 years of experience in general management, manufacturing, distribution, and financial management. Most of his career was spent in manufacturing and distribution where he worked on a number of acquisitions from negotiations thru integration.

Learn more about Tom Kerchner here.