Acquisitions and Premium Valuations for Electronic Product Manufacturers to Continue

Overview

Acquisition activity in the middle market electronic product manufacturing space is strong heading into 2020. A broad base of strategic OEMs, Private Equity, and Private Family Offices are paying premium valuations for middle-market electronic manufacturing product businesses.

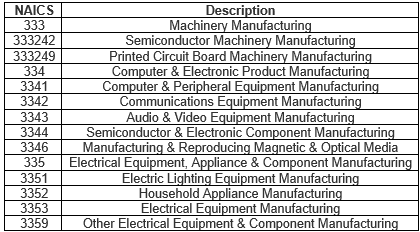

Electronics Product Manufacturing

The North American Industry Classification System (NAICS) is the standard used by Federal statistical agencies in classifying business establishments for the purpose of collecting, analyzing, and publishing statistical data related to the U.S. business economy. For purposes of this analysis, we included the following codes:

Who’s Buying?

Historically low interest rates and a robustly growing economy have driven the acquisition industry. Private equity groups as well as private family offices have access to significant capital and are actively pursuing middle-market acquisitions. Strategic OEMs also see the low cost of capital and high share prices as a means to pursue inexpensive growth by acquiring established lower middle-market businesses. These trends are likely to continue as long as interest rates remain at historic low levels.

Valuation Multiples

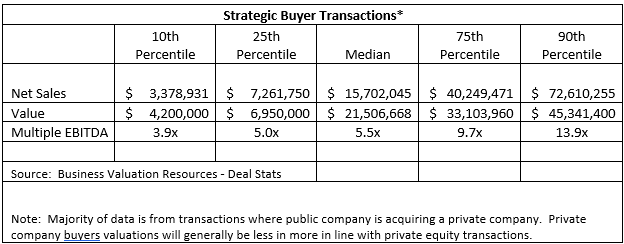

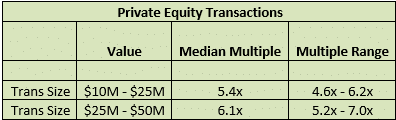

The three most common approaches to business valuation are the asset, income, and market-based approaches. For middle-market firms, the market-based methodology is the most widely used and accepted. The fundamental premise of this approach is that the business valuations of a target company can be estimated by examining historical transactions within the same/similar industry and similar size.

Note that most businesses valuations are based on a multiple of cash flow (EBITDA). Historically price multiples vary depending on both the industry, the industry sub-segment as well as the size and quality of the company’s cash flow (EBITDA). Therefore, a range of valuation for the target business can be estimated by examining historical similar transactions and then applying the historical range of multiples to the target EBITDA to generate an estimated range of valuation.

It should be noted that electronic product manufacturers operating in the middle market historically receive a premium valuation multiple when compared to the overall market.

The following data from BVR and GF Data outlines representative historical multiples in the mid-market electronic products industry. Note the change in multiple based on both transaction size as well as the type of buyer. Private buyers tend to be financial buyers whereas public buyers typically are strategic OEMs. Strategic OEM’s generally offer premium valuations based on the perceived value to be gained from the acquisition including access to IP, Products, Customers, Markets, etc. However, valuations from strategic buyers can vary widely depending on the target companies unique characteristics.

It is also important to point out that multiples will also vary by the specific sector or sub-segment within the electronics manufacturing products industry. For example, there is a 158% difference in the historical median multiple when comparing computer and electronic products (NAICS 334) to electrical equipment (NAICS 335). In addition, there is a 175% difference in the historical median multiple when comparing the six sub-segments within NAICS 334.

Electronic Manufacturing Valuation Multiples – Select Data

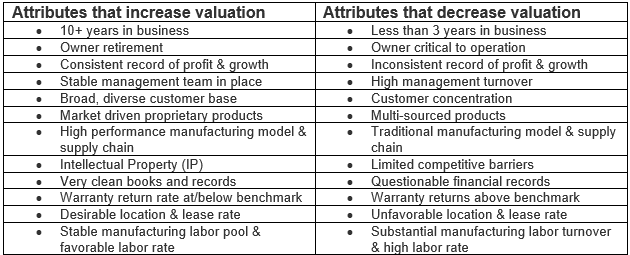

Valuation Drivers

Numerous attributes of a business can warrant an increase or decrease in valuation within the range.

Summary

Low-interest rates and a robust and growing economy are driving growth in acquisitions. Private Equity, Private Family Offices, and other financial buyers have access to unprecedented levels of low-cost capital and are seeking high returns by completing acquisitions in the middle-market electronics market. In addition, Public OEM’s are using low-interest rates and high share prices combined with premium valuations to pursue strategic growth thru acquisition. Owners of electronic product manufacturing businesses that are thinking of selling their business should engage with a professional M&A advisor early in the process to fully understand current valuation, as well as the attributes and characteristics acquiring organizations, are seeking.